Embarking on the journey to retirement is like preparing for a grand adventure– the excitement is palpable, but not everyone equips themselves for the voyage. While the day might seem like a distant horizon, the truth is that it’s never too early to chart your course.

In my role as a financial advisor, I know the importance of crafting a comprehensive financial plan that intricately weaves through your unique circumstances, objectives, and long-term goals. In this blog, I’ll discuss why retirement planning is an important roadmap that affects your financial decisions now and long term, and why having a knowledgeable guide is essential in steering you toward the retirement you’ve envisioned.

Top 5 Reasons Why It’s Important to Plan for Retirement

1. Simplify cash flow for a stress-free retirement

Planning for a comfortable retirement involves careful consideration. Your expected lifestyle, based on current income and spending, may not match the realities of living longer than expected.

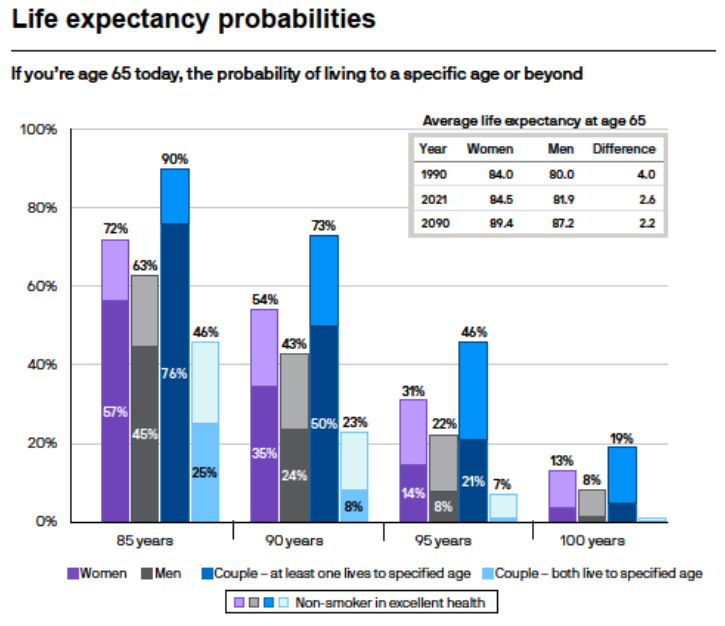

For instance, according to JP Morgan’s Guide to Retirement, a 65-year-old couple faces a 50/50 chance of one of them reaching their 90s, with a 21% chance of reaching 95, and these odds increase for those in good health. It’s common for clients to be surprised by this, often influenced by the shorter lifespans of previous generations. This misconception can lead to the belief that retirement spans only 10-15 years when, in reality, it often extends closer to 25-30 years.

The average life expectancy is a mid-point, not an end-point.

Are you prepared for the entire journey?

Source: 2023 JP Morgan Guide to Retirement

Advisors provide objectivity, accountability, and expertise in crafting a budget for long-term financial goals like debt repayment, retirement savings, and living comfortably throughout your entire retirement. Having a trusted advisor regularly review and optimize your portfolio will strategically navigate inevitable fluctuations, while staying focused on the end goal which is to live your retirement fully and without worry for as long as you live.

At Toberman Becker, we take the time to get to know our clients. We ask the right questions and listen. Though spending patterns could be a challenging conversation, it doesn’t have to be uncomfortable. We leverage our knowledge and expertise to craft comprehensive financial plans that extend beyond budgeting, but also consider savings, investment diversification, insurance, tax strategies, and life expectancy—all aimed at minimizing risk subject to your unique and changing financial goals and needs throughout your entire life.

2. Prepare for the expected and conquer the unexpected

Life continues to present changes and challenges even after retirement. In your 50s and 60s, your family may be experiencing significant milestones. Whether it’s providing additional care or financial assistance to aging parents or supporting children through college, weddings, or home purchases, these unforeseen financial responsibilities can become substantial expenses.

Financial advisors excel at anticipating the future. They play a vital role in helping individuals navigate these hurdles by creating a comprehensive retirement plan. Advisors consider factors such as budgeting, insurance coverage, investment strategies, and emergency funds. This proactive approach ensures financial security throughout retirement. Something that is often overlooked is liquidity. How quickly can this investment be converted to spendable dollars? Making sure we address liquidity with all clients helps with understanding how unforeseen items would be taken care of.

Retirement Expenses: The Foreseen and Unforeseen

| Foreseen Expenses | Unforeseen Expenses |

|---|---|

| Living expenses | Healthcare emergencies |

| Healthcare costs | Home repairs |

| Travel & Leisure | Family support |

| Taxes | Market fluctuations |

| Home maintenance | Inflation |

| Legal costs | |

| Long-term care |

At Toberman Becker we explain the predictable, anticipate the unforeseen, and prepare for the inevitable. Our approach equips you with the knowledge and assurance as you move towards retirement. By understanding future possibilities, we enable precise planning for all life’s events while keeping your portfolio aligned with your personal financial goals.

3. Plan your future, own your confidence

When deciding to invest, there’s always risk involved. However, the amount of risk an individual is willing to take on varies from person to person. A reliable advisor takes a comprehensive approach by understanding each of their client’s unique profiles, expectations, and risk tolerance. They avoid unnecessary risks and remain transparent about the potential consequences that come at the different risk levels.

Through ongoing discussions and diligent monitoring, the advisor adjusts the portfolio to align with the client’s evolving life circumstances. This ensures that the portfolio remains aligned with long-term goals, even in volatile times, so the client can build confidence in their financial future.

At Toberman Becker we take the time to understand your short-term objectives, your long-term goals, and your vision for the future. We conduct thorough risk assessments, evaluating factors such as market volatility, inflation, geopolitical risks, and personal circumstances that may impact your financial well-being. We customize a financial plan that never exceeds your risk tolerance and can do well in any type of market.

4. Safeguard you, secure your assets

Ongoing technological advancements are making everyone more susceptible to scams. Building a trusting relationship with a financial advisor over time fosters open conversations about finances and potential abuse while creating a safe space for disclosures. This relationship empowers individuals, especially seniors, to overcome judgment fears, be more willing to share experiences that could help in fraud protection, prevent similar scams, and nurture a secure professional bond.

At Toberman Becker we collaborate with clients to provide technological support for retirees. This includes:

Educating retirees on effective strategies for how to protect themselves and their assets.

Being a resource for password management and a guide for software updates.

Staying informed of the latest financial scams and educating clients on how to avoid the most common fraudulent tactics.

Supporting clients as they designate trusted individuals to act as their representatives.

Implementing a robust system that helps monitor financial accounts.

Assisting with estate planning.

5. Minimize taxes with strategic legacy planning

After securing a worry-free retirement, many clients opt to use their extra savings to establish a legacy for future generations. An advisor can help you in crafting an investment strategy that optimizes your gift while minimizing tax implications. The recent amendments to the Secure Act have made this process more complex, and a knowledgeable advisor is well-versed in navigating the intricacies. They can guide you through potential obstacles, ensuring that the revised tax laws don’t pose a financial burden on your loved ones.

At Toberman Becker our expertise lies in organizing assets, reducing taxes, and ensuring efficient asset transfer to intended beneficiaries. We’ll help align financial goals with legacy wishes, establish trusts, and navigate complex legal and financial processes, offering peace of mind in passing on wealth and values to future generations.

Benefits of working with an advisor

A reliable financial advisor eliminates uncertainty from the equation. Rather than venturing into an unpredictable future blindly, you’ll have a dependable partner to accompany you through the journey into and throughout retirement. They’ll help you navigate intricate financial milestones during the active go-go years (typically ages 65-75), the slower-paces slow-go years (typically ages 76-85), and the more relaxed no-go years (typically ages 86-100). While it’s possible to travel this path alone, the expertise of a fee-only fiduciary ensures optimal savings and peace of mind

Toberman Becker Wealth is a fee-only, independent fiduciary firm based out of St. Louis. Whether starting to invest for retirement in your 50s or actively planning for retirement in your 60s, we help people nearing a transition build a resilient retirement plan. We operate in the best interests of our clients, always, and our top priority is to help you live comfortably now, without sacrificing your financial future later.

If you’re looking for an investment advisor to help you build a diversified strategy that hedges against risk, feel free to book a meeting or give us a call.

Disclosure: Any mention of a particular security and related performance data is not a recommendation to buy or sell. The information provided on this website (including any information that may be accessed through this website) is not directed at any investor or category of investors and is provided solely as general information. Nothing on this website should be considered as personalized financial advice or a solicitation to buy or sell any securities.

Michael is a highly knowledgeable and experienced partner at Toberman Becker Wealth in St. Louis. With his expertise in investment management, behavioral finance, and retirement planning, Michael is dedicated to providing his clients with the best financial guidance possible.

Having worked with clients on complex estate planning and developing investment strategies for a team of advisors, Michael’s experience spans across various areas of financial planning. What truly sets him apart is his unyielding desire to acquire knowledge for the betterment of his clients. At Toberman Becker Wealth, this commitment to continuous learning is the foundation upon which exceptional client experiences are built.

Michael earned a Bachelor of Science degree in Finance and Banking from the University of Missouri – Columbia. Additionally, he holds designations as a Chartered Financial Analyst (CFA) charterholder and Certified Financial Planner (CFP).

Beyond his professional achievements, Michael enjoys a fulfilling personal life in St. Louis. Living with his wife, Lindsey, and their beloved dog, Birk, he finds joy in activities such as golfing together and exploring local restaurants.