How Do I Choose the Best Bond Maturity Range for My Investment Goals?

Setting Up Your Fixed Income Portfolio While Managing Inflation Risk

Retirees today face challenges in a changing economic landscape. Despite pensions and Social Security, inflation threatens financial stability in retirement, especially in healthcare costs.

This article highlights the importance of incorporating bonds into your investment portfolio and offers guidance on allocating them within your fixed-income assets. We discuss the strategic selection of bond maturities and introduce the bond ladder strategy to help align with your financial goals, manage risk, and potentially enhance returns. Explore bond investing with us to safeguard your retirement against future uncertainties.

What are bond investments?

Different types of bonds are available, such as federal government, corporate, and municipal bonds, each carrying varying levels of credit risk. At Toberman Becker, we usually recommend our clients invest in government bonds for the safest portion of their retirement nest egg since they are usually considered extremely low-credit-risk investments. These bonds are backed by the government’s “full faith and credit,” meaning – in the case of a U.S. Treasury investment – that the U.S. government is contractually obligated to repay the debt.

This makes the odds of default extremely low, with the historical default rate for U.S. Treasury bonds being essentially zero. For these reasons, they are a good choice for conservative investors and those nearing retirement.

What factors should you consider when choosing bond maturities for your portfolio?

1. Asset-liability matching

How much do you need and when?

The first step in fixed-income investing involves employing a risk management strategy known as asset-liability matching. This entails comparing future asset sales and income streams with your liabilities and anticipated expenses. By timing your cash flows to coincide with when you need funds, you can customize a portfolio that maximizes returns and minimizes risks to achieve your financial goals.

For example, retirees who depend on income from their portfolios typically require stable and continuous cash flow to supplement their Social Security benefits. A matching strategy involves strategically purchasing securities that pay dividends and interest at regular intervals. This ensures that you receive your money, plus interest before you need it. This approach helps build a diversified and reliable portfolio and helps ensure you will not be forced to sell stocks while they are down to fund your goals.

2. Be aware of future inflation projections.

How much inflation risk can you take on?

High inflation impacts everyone, but it poses a significant and distinct threat to a retiree’s portfolio. Outside of Social Security, retirees’ income is often less indexed to consumer price increases, which can lead to an eroding purchasing power over time.

Rising healthcare costs, the most significant expense retirees face, are particularly concerning as they tend to increase faster than general economic inflation. Since 2000, the inflation rate of healthcare costs has significantly outpaced the general consolidated inflation rate (i.e., All Items). Inflation can become a critical risk for retirees without a consistently inflating income to combat these rising prices.

Since 2000, healthcare costs have surged due to inflation, outpacing the general rate of inflation in the economy, and the gap continues to widen. Where will this trend lead in the future, and how can you prepare?

Retirees cannot rely solely on benefits and pensions to cover these increased costs. To manage the unpredictable financial landscape and account for future inflation, they must fine-tune their financial projections and diversify their portfolios, usually by blending an inflation-minded bond strategy with a long-term equity growth strategy.

You can hedge against this inflation risk through customized management of your fixed-income portfolio. Keeping bond durations short with staggered maturities helps mitigate future inflation risks. Shorter-term bonds provide a better hedge to the risk of future inflation and unexpected rises in interest rates. Conversely, longer-term bonds increase exposure to these risks, which is undesirable for retirees who may wish to hedge – or “buy insurance” – against the risk of future unexpected inflation.

To further mitigate interest-rate risk, use an asset-liability matching strategy and consider bonds with a diversified range of short- to medium-term maturities. This approach helps dampen the impact of interest rate fluctuations that could negatively impact your investment outcomes.

3. Consider the credit risk of your investment

How much credit risk do you want to incur, and are you being properly compensated for it?

In theory, all bonds carry credit risk. You inherit risk because you are essentially lending money to the bond issuer and there’s always the chance that the issuer could default on payments, potentially leading to income and principal losses.

Carefully assess the creditworthiness of the bond issuer, as not all fixed-income investments offer the same level of security. For instance, according to credit rating agencies, investing in U.S. Treasury bonds involves minimal credit risk compared to many other global bonds and especially many corporate bonds.

Additionally, consider the types of investments you’re making. For example, people who hold fixed-income or bond investments have a higher legal claim than equity investors. If you hold equity in a company and that company goes bankrupt, you have no claim to any assets. However, investing in bonds is viewed differently through our legal structure and has a higher claim on the capital structure than equity investments in the event of insolvency.

In today’s dynamic financial landscape, especially for retirees relying on fixed-income streams, prioritizing bonds that carry minimal credit risk in the safest portion of your retirement nest egg can bring valuable peace of mind.

4. Plan for interest rate risks

How does the time until maturity of a bond affect its exposure to unexpected fluctuations in market interest rates??

Understanding how fluctuating interest rates can affect the value of your bonds is crucial. Bonds are susceptible to interest rate risk: as interest rates rise, bond prices typically decline. This relationship means that if you need to sell a bond before it matures, you might incur a loss compared to its initial purchase price. Remember, while the Federal Reserve can manually set the shortest-term “Overnight” Federal Funds Rate, the “market” ultimately determines the level of longer-term rates like the 10-year Treasury rate at any given point in time.

When interest rates rise, having a large allocation in long-term bonds is less favorable. While the Federal Reserve controls the overnight rate, the 10-year rate is “discovered” dynamically through market price discovery between buyers and sellers.

Investing heavily in long-term bonds becomes less favorable if interest rates unexpectedly increase. The longer you hold a bond, the more exposed you are to fluctuations in interest rates. Despite this risk, bonds are typically considered less volatile than equities, making them a foundational element in a diversified investment portfolio.

By using an asset-liability matching strategy, interest-rate risk can be effectively eliminated. If an investor in a U.S. Treasury investment expects to hold their investment until maturity, they rely on the full faith and credit of the U.S. government. This guarantee ensures they will receive the return of their principal at that time. Therefore, any fluctuations in the value of that investment due to interest rate changes over the holding period will be a moot point to that investor.

Choose the Right Maturity Range: Set Up Your Fixed Income Portfolio to Mitigate Risk

By strategically planning for your financial future, you can ultimately structure a portfolio that incorporates bonds as a way to hedge the risk of more volatile investments like stocks. Bonds can provide a steady stream of cash flow during your retirement years. Since bond investments can typically mature from 3 months to 30 years, they can be entirely customized to meet our client’s specific financial needs.

At Toberman Becker, we firmly believe from a credit-risk standpoint that there is no safer cash flow-producing investment strategy than investing in a U.S. Treasury ladder for our clients. Since T-Bills are considered extremely safe, being fully backed by the U.S. government, Treasury bonds offer a reliable way to generate returns while managing inflation, credit, and interest rate risk.

“The treasury laddering strategy is one of the most powerful strategies in existence for a long-term retirement investor looking to manage their cash flow and create peace of mind against adverse economic events that could arise.”

Craig Toberman, CFA, CPA, CFP®

We start by taking a comprehensive look at your assets, income stream, and future anticipated expenses. Applying the asset-liability matching strategy, we formulate a plan, staggering maturity dates as soon as three months and up to 30 years. However, since the world changes dynamically, we seek to maintain flexibility, usually sticking with fixed-income investments weighted more heavily in the short- to medium-term so we can adapt and avoid incurring undesirable inflation risk through overexposure to long-term bonds.

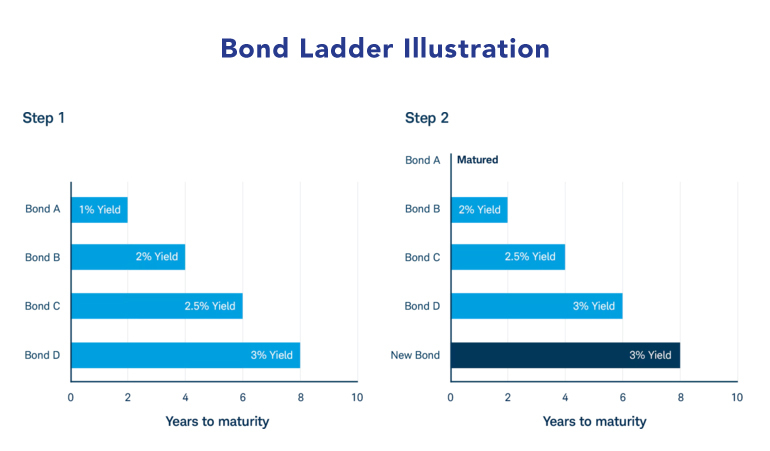

Using a bond ladder strategy, an investor buys several bonds with staggered maturities. Once bond A matures, the investor reinvests the proceeds into a new bond, extending the ladder.

Source: Charles Schwab

Our process seeks to manage inflation risk by selecting shorter maturities to ensure we don’t tie up funds for too long, thus hedging inflation. This approach allows for regular revaluation in conjunction with all the components in our Retirement Decision Dashboard.

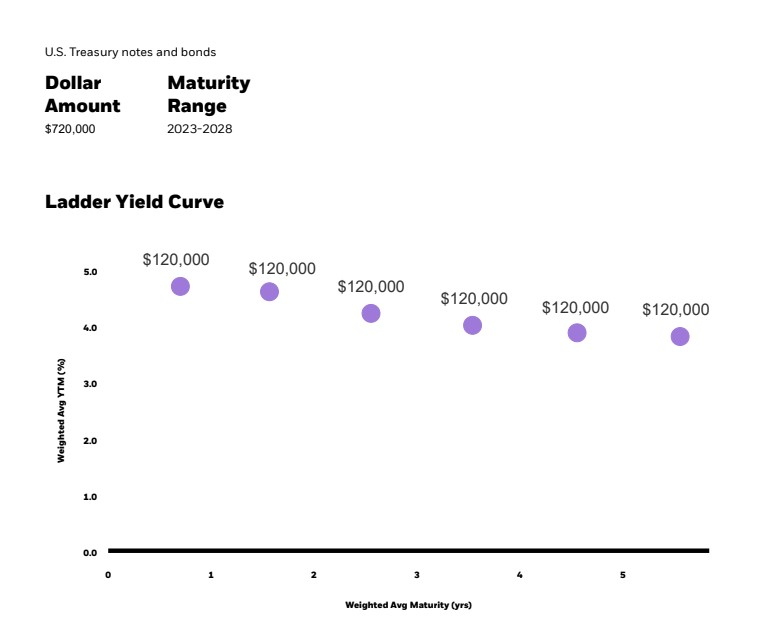

U.S. Treasury Bonds and Notes Ladder Yield Curve

The longer the overall duration of a bond portfolio, the more exposure to the risk of higher-than-expected future long-term inflation.

As near-term bonds mature, our clients can choose to use the proceeds to fund their retirement spending, rebalance into stocks, or roll them into higher rates at the end of the ladder if rates have risen. This strategy helps capture higher yields in a rising rate environment compared to an aggregate longer-term bond fund by mitigating risk when interest rates rise while providing a steady cash flow as some portion of the retirement portfolio matures each year as planned.

In conclusion

Feeling confident and secure in your retirement portfolio is challenging but achievable. By implementing the asset-liability matching strategy and considering inflation, credit, and interest rate risks, incorporating low-risk shorter-term Treasury Bonds into your overall portfolio emerges as a highly reliable choice. Laddering bond maturities effectively serves as an insurance policy, ensuring predictable income streams while mitigating risk during volatile times.

Toberman Becker Wealth is a fee-only, independent fiduciary firm based in St. Louis. Whether starting to invest for retirement in your 50s or actively planning for retirement in your 60s, we help people nearing a transition build a resilient retirement plan. We operate in the best interests of our clients, always, and our top priority is to help you live comfortably now, without compromising your financial future later.

If you’re looking for an investment advisor to help you craft a diversified strategy that safeguards against risk, feel free to book a meeting or give us a call.

Continue Exploring Our Retirement Decision Dashboard

Disclosure: Any mention of a particular security and related performance data is not a recommendation to buy or sell. The information provided on this website (including any information that may be accessed through this website) is not directed at any investor or category of investors and is provided solely as general information. Nothing on this website should be considered as personalized financial advice or a solicitation to buy or sell any securities.

Craig Toberman is a Partner at Toberman Becker Wealth – a fee-only, fiduciary financial advisor based in St. Louis. He assists families and businesses with strategic financial planning and long-term wealth management. He has over a decade of experience in financial services and has crafted custom financial plans for hundreds of families and businesses.