The Windfall Effect: How the Great Wealth Transfer is Changing Financial Futures

Discussions and inquiries about the “Great Wealth Transfer” have taken center stage in the financial world, with media outlets emphasizing its potential to improve the financial landscape for millions of Americans. A generational wealth transfer of this scale presents opportunities and challenges, making it a critical issue for economists, policymakers, and, most importantly, families.

As a financial advisor, my conversations with clients about retirement decisions often address a desire to preserve assets to pass along to the family. This article aims to answer key questions about the positive and negative realities of the Great Wealth Transfer and provide guidance on how retirees can prepare themselves and their heirs for an advantageous transfer of wealth.

Why Is the News Talking So Much About the Great Wealth Transfer?

Media coverage of the Great Wealth Transfer reflects the magnitude of the projected shift in wealth between the Baby Boomer generation and their beneficiaries. Baby Boomers, born between 1946 and 1964, are one of America’s largest and wealthiest generations. As such, the Great Wealth Transfer is relevant to every adult generation in America and every news outlet they consume.

What Is the “Great Wealth Transfer” & Who Does It Affect?

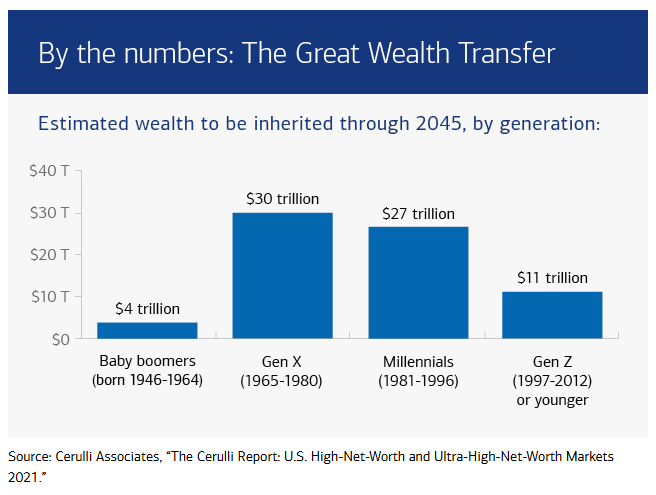

The Great Wealth Transfer refers to an estimated $84 Trillion in assets that will pass from Baby Boomers to younger generations, including:

- Generation X | Born 1965-1980

- Millennials | Born 1981-1996

- Generation Z | Born after 1996

This transfer is already underway and will accelerate in the coming decades, with an expected peak in the 2030s and 2040s. During this time, Baby Boomer estates will pass on significant assets such as cash, investments, real estate, and privately held businesses.

The Great Wealth Transfer will have wide-ranging impacts on American families, the economy, and public policy:

- Heirs & Beneficiaries

Inherited wealth offers newfound financial security and opportunities to reevaluate priorities such as funding education, paying off debt, buying homes, or investing in businesses. - Finance Industry

Banks, investment firms, and wealth management advisors will play a critical role in guiding Boomers through estate decisions and helping the next generation manage inheritances. - Job Market

With the added security of an inherited nest egg, beneficiaries can have more freedom and flexibility to pursue careers driven by passion and personal fulfillment rather than solely financial necessity. - Economy

As younger adults control more of the country’s capital, the economy may shift due to generational spending habits, risk appetites, and investment strategies. - Tax Policy

Federal lawmakers may adjust estate tax and capital gains regulations in response to the transferred wealth volume.

- Heirs & Beneficiaries

What Concerns Arise in Connection to a Historic Wealth Transfer?

As trillions in assets change ownership within a brief window, challenges will likely arise regarding market volatility, social equality, and the inherent learning curves of first-time wealth management.

- Wealth Disparities

A primary concern is how wealth transfers might exacerbate wealth inequality in our country, widening the gap and fueling tensions between the rich and the poor. According to the financial research firm Cerulli Associates, high-net-worth individuals will execute 42% of the volume of expected transfers even though they only represent 1.5% of all households. - Lack of Financial Preparedness

Many beneficiaries may need more financial literacy to manage a sudden inheritance, large or small. With proper guidance and a prudent strategy, heirs may be able to maintain new wealth due to overspending, poor investments, or even being the target of a financial scam. - Tax Implications

Inherited IRA Required Minimum Distributions, estate taxes and capital gains taxes complicate most wealth transfers. Tax planning is crucial to address any potential changes to tax law to protect the net amount of inheritance. - Market Reactions

Asset ownership affects market dynamics, and younger individuals may have different risk tolerances or investment preferences, which could increase market volatility. Many Baby Boomers have held stock in the same companies for decades, primarily due to the capital gains tax associated with selling them. Oftentimes, these holdings grow to be significantly overweight in the portfolio.When those owners pass away, current tax law will allow for a “step-up” in cost basis which means the capital gain will go away upon inheritance. Companies with 40+ year track records face headwinds as their longtime owners begin to pass away, and heirs may no longer desire to hold them. Younger generations preferred indexing strategies less popular when Baby Boomers began investing.

- Wealth Disparities

Will the Great Wealth Transfer Lead to Financial Windfall?

Though individuals with wealthy parents or grandparents in the Boomer generation are likely to inherit significant assets during the Great Wealth Transfer, a financial windfall is not guaranteed for all.

Factors such as taxes, outstanding debts, philanthropic endowments, or multiple heirs can diminish the extent of an individual’s inheritance. Additionally, wills and estate plans contain highly personal and often unpredictable decisions made with full autonomy by the deceased.

How Can Americans Prepare for the Great Wealth Transfer?

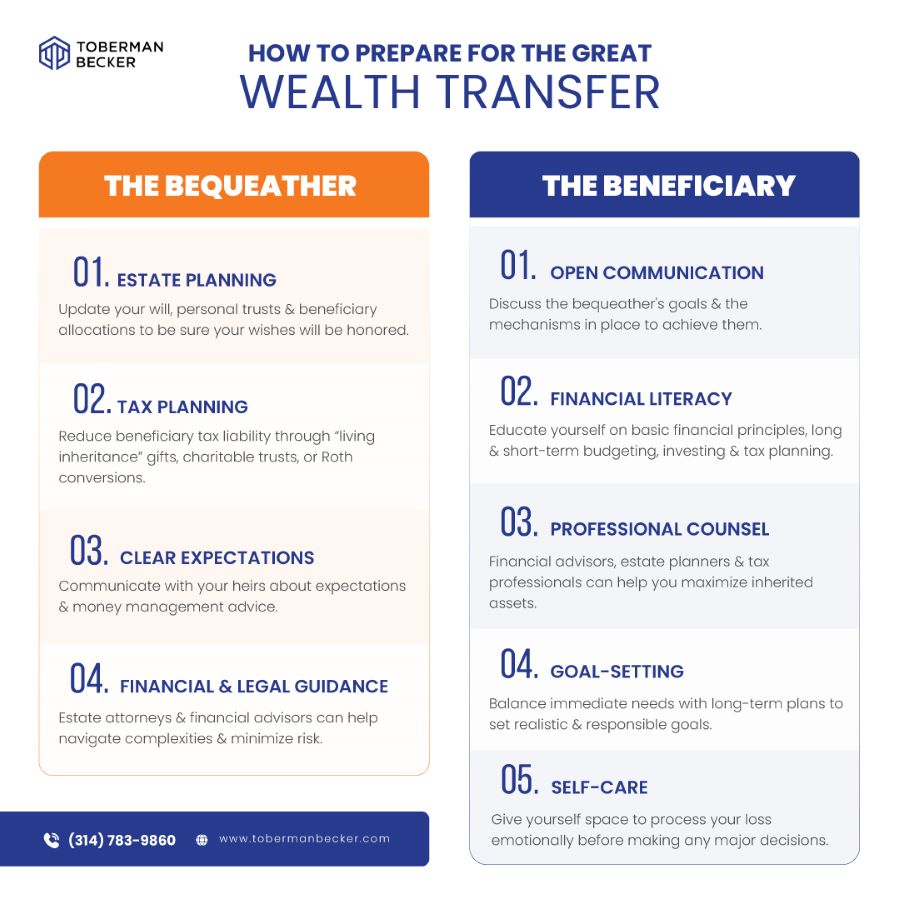

Preparing for a transfer of wealth requires proactive engagement from all parties to deepen financial aptitude regarding estate planning, wealth management, and tax strategy.

Actual preparation tactics will vary for each generation:

If You’re Expecting an Inheritance…

- Talk to the Grantor

The grantor is the person providing the inheritance. It is important to talk with them about their goals and understand the mechanisms they have in place to accomplish those goals (Wills, Trusts, etc). This will allow you to make proactive decisions about your own finances in preparation of a future inheritance. - Improve Financial Literacy

Seek education on basic financial principles, including long and short-term budgeting, investing, and tax planning. - Talk to a Professional

Financial advisors, estate planners, and tax professionals can help you develop a personalized strategy to protect and maximize inherited assets. - Set Clear Goals

Consider how you want to use the inheritance, balancing your immediate needs with future ones. Consider your personal and financial goals, evaluating how the inheritance best supports your lifestyle. - Prepare Emotionally

In reality, the emotional aspects of inheritance often overshadow the financial implications. Beneficiaries should give themselves space to mourn and process their loved one’s death before diverting energy toward making major financial decisions.

If You’re Bequeathing Wealth to the Next Generation…

- Estate Planning

Create or update your will, personal trusts, and beneficiary allocations. This guarantees that your assets will be distributed per your wishes. In contrast, vague or unclear estate plans can complicate or misrepresent your intentions, causing confusion or angst for your heirs. - Tax Efficiency

To reduce tax liability for the next generation, consider “living inheritance” gifts, charitable trusts, or Roth conversions. A Roth IRA, which is income-tax-free for heirs, allows adult children to inherit funds without federal income tax burdens—especially valuable during their high-earning, high-tax years. - Set Clear Expectations with Heirs

Per your comfort level and family circumstances, initiate open dialogue with your beneficiaries to set expectations and provide guidance on how they might manage any inheritance. - Professional Guidance

Consult with estate planning attorneys and financial advisors to minimize risks and navigate legal and regulatory complexities.w

- Talk to the Grantor

Conclusion

The Great Wealth Transfer marks a monumental occasion with far-reaching financial implications for retirees, families, and the national economy. Proactive planning and intergenerational collaboration are key to harnessing its benefits while minimizing risks.

At Toberman Becker Wealth, we work closely with clients to craft secure financial legacies for loved ones. Contact us today to start building a resilient retirement plan.

Toberman Becker Wealth is a fee-only, independent fiduciary firm based in St. Louis. Whether you start dreaming about retirement in your 50s or actively planning for retirement in your 60s, we help people nearing a transition build a resilient retirement plan. We always operate in the best interests of our clients, and our top priority is to help you live comfortably now without sacrificing your financial future later.

If you’re looking for an investment advisor to help you build a diversified retirement plan that ensures comfort and peace of mind, feel free to book a meeting or give us a call.

Disclosure: Any mention of a particular security and related performance data is not a recommendation to buy or sell. The information provided on this website (including any information that may be accessed through this website) is not directed at any investor or category of investors and is provided solely as general information. Nothing on this website should be considered as personalized financial advice or a solicitation to buy or sell any securities.

Michael is a highly knowledgeable and experienced partner at Toberman Becker Wealth in St. Louis. With his expertise in investment management, behavioral finance, and retirement planning, Michael is dedicated to providing his clients with the best financial guidance possible.

Having worked with clients on complex estate planning and developing investment strategies for a team of advisors, Michael’s experience spans across various areas of financial planning. What truly sets him apart is his unyielding desire to acquire knowledge for the betterment of his clients. At Toberman Becker Wealth, this commitment to continuous learning is the foundation upon which exceptional client experiences are built.

Michael earned a Bachelor of Science degree in Finance and Banking from the University of Missouri – Columbia. Additionally, he holds designations as a Chartered Financial Analyst (CFA) charterholder and Certified Financial Planner (CFP).

Beyond his professional achievements, Michael enjoys a fulfilling personal life in St. Louis. Living with his wife, Lindsey, and their beloved dog, Birk, he finds joy in activities such as golfing together and exploring local restaurants.