How to Protect Your Retirement From Inflation: Smart Investment Strategies

The topic of inflation and its far-reaching impact on the economy has dominated the news in recent years. And while it’s keenly felt at the gas pump and grocery store, it can have an even more insidious, and often hidden, effect: quietly derailing a retirement plan.

In this article, I discuss what inflation is, why it matters for retirees, and which strategies can help protect your retirement investments over the long term.

What Is Inflation?

Inflation is the persistent and broad increase in prices, or the decrease in the value of money over time. It is largely influenced by supply and demand.

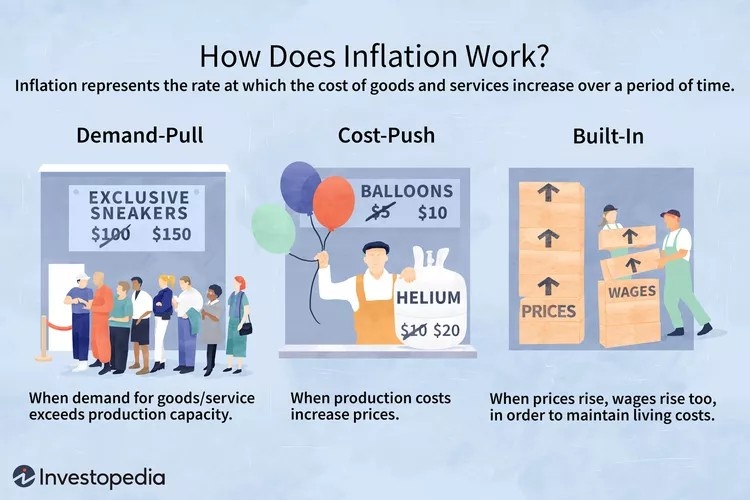

There are three main types of inflation:

- Demand-pull inflation

This occurs when demand for products and services exceeds the economy’s supply. Too many buyers chasing too few goods naturally pulls prices higher. - Cost-push inflation

This happens when production costs such as materials, wages, and energy increase and businesses pass those higher costs on to consumers. Tariffs, new regulations, and supply chain disruptions are common drivers of cost-push inflation. - Built-in inflation

When consumers and workers expect prices to keep rising, employees demand higher wages to maintain their purchasing power, and businesses raise prices to offset those wage increases. In this way, the expectation of inflation helps fuel ongoing inflation.

Source: Investopedia

In addition to supply and demand, global events and government policies can accelerate inflationary cycles.

What Causes Inflation? Key Economic Factors Explained

Inflation can’t be traced to a single cause; instead, it usually results from the interaction of multiple economic forces. Below are four key drivers that have contributed to recent inflationary pressures:

- Geopolitical unrest

Conflict disrupts logistics and transportation networks, making it more complicated and more expensive for suppliers to operate. These disruptions can ripple through global supply chains, pushing prices higher. - Money printing and monetary policy

When governments or central banks increase the money supply, it can reinforce inflation. Although the goal is to stimulate spending, if the money isn’t used productively:- Businesses may weaken

- Prices may go up

- Money may lose its value

- Deglobalization of the supply chains

Globalization helped lower costs through access to cheaper labor and materials. Recent shifts toward reshoring and deglobalization may limit that access, raising production costs and reducing supply-chain efficiency. - Decarbonization and energy transition costs

Clean-energy initiatives require significant investment in new technologies and infrastructure. These costs may increase production expenses, which businesses pass to consumers.

5 Strategies to Help Protect Your Retirement Investments From Inflation

While short-term inflation spikes can feel unsettling, proper planning can help keep your 30-year retirement on track. By adopting a risk-management mindset and building a holistic “insurance” framework, you can better protect your portfolio from inflation over the long term.

Here are five ways to minimize inflation’s impact on your retirement investments:

- Diversify Your Bond Portfolio

When you purchase a bond, you lend money to an issuer (government, municipality, or corporation), and in turn, the issuer promises to pay you a specific rate of interest during the life of the bond and repay you the principal when it “matures” or comes due after a set period of time.

- Diversify Your Bond Portfolio

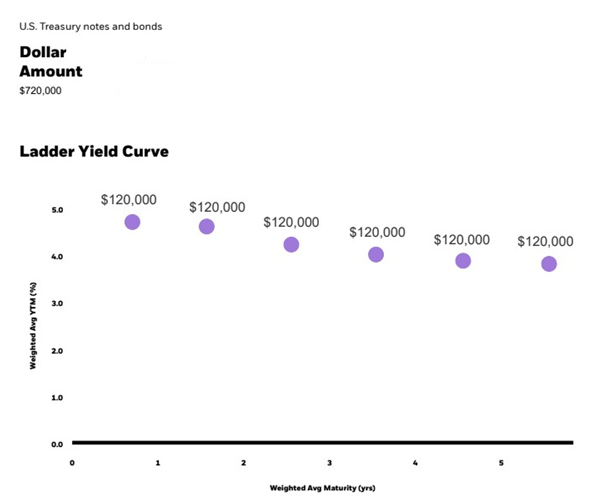

U.S. Treasury Bonds and Notes Ladder Yield Curve

Illustrates how a bond ladder helps reduce inflation-related risk by spreading

$720,000 across six equal Treasury investments with staggered maturity dates.

Bonds provide steady income, but inflation erodes the value of those future payments. To protect your bond holdings, diversify your portfolio by:

- Mixing short- and long-term bonds

Long-term bonds are more sensitive to inflation and rising rates. You can offset some of this inflationary risk by buying short-term bonds and reinvesting the principal. - Investing in Treasury Inflation-Protected Securities (TIPS)

TIPS are bonds that adjust with inflation. Though initial yields are lower, they offer valuable long-term protection. - Holding different bond types

Combine U.S. Treasury issues, Certificates of Deposit (CDs), and municipal bonds to reduce credit risk, and stagger maturity rates to lessen interest-rate risk.

- Mixing short- and long-term bonds

Bonds can provide a reliable retirement income; however, fixed-rate bonds alone may not provide enough growth. Complement them with assets that historically outpace inflation.

- Invest in Stocks for Long-Term Growth

Stocks, though riskier than bonds, tend to more easily keep up with inflation because companies can increase prices during inflationary periods.- Balance profitability with future growth

Stocks priced heavily on future earnings can behave like long-term bonds (more vulnerable to inflation and rising interest rates). Growth companies can offer great upside opportunities, but they carry additional risk because they are more likely to price in future earnings that have not yet occurred. - Consider a mix of high-quality stocks

A balanced portfolio includes both profitable, established companies and those with higher growth potential. This mix can provide stability through current earnings, some protection against inflation, and continued exposure to future upside.

- Balance profitability with future growth

-

Think About Real Assets

Real assets (physical, tangible assets) often hold up well during inflationary periods and add diversification. They include: - Real estate: Housing prices and rents tend to rise with inflation.

- Raw materials: Energy, metals, and agricultural products often increase in price during inflationary periods (but keep in mind they’re highly susceptible to geopolitical and weather events).

- Infrastructure: Essential services like utilities, toll roads, and pipelines often generate inflation-linked revenue streams and can provide steady cash flows regardless of economic conditions.

- Goals-Based Investing

Numbers don’t tell the full story. Goals-based investing gives your investments meaning and helps your advisor develop a plan that reflects your values and goals. - Short-term investment goals include paying down debt, building an emergency fund, or helping family with upcoming expenses (e.g., a grandkid’s college costs).

- Long-term investment goals include your desired retirement lifestyle, legacy planning, and generational wealth goals.

- Timing and Strategy Use smart investment timing strategies to manage inflation and market volatility.

- Be mindful of when to purchase

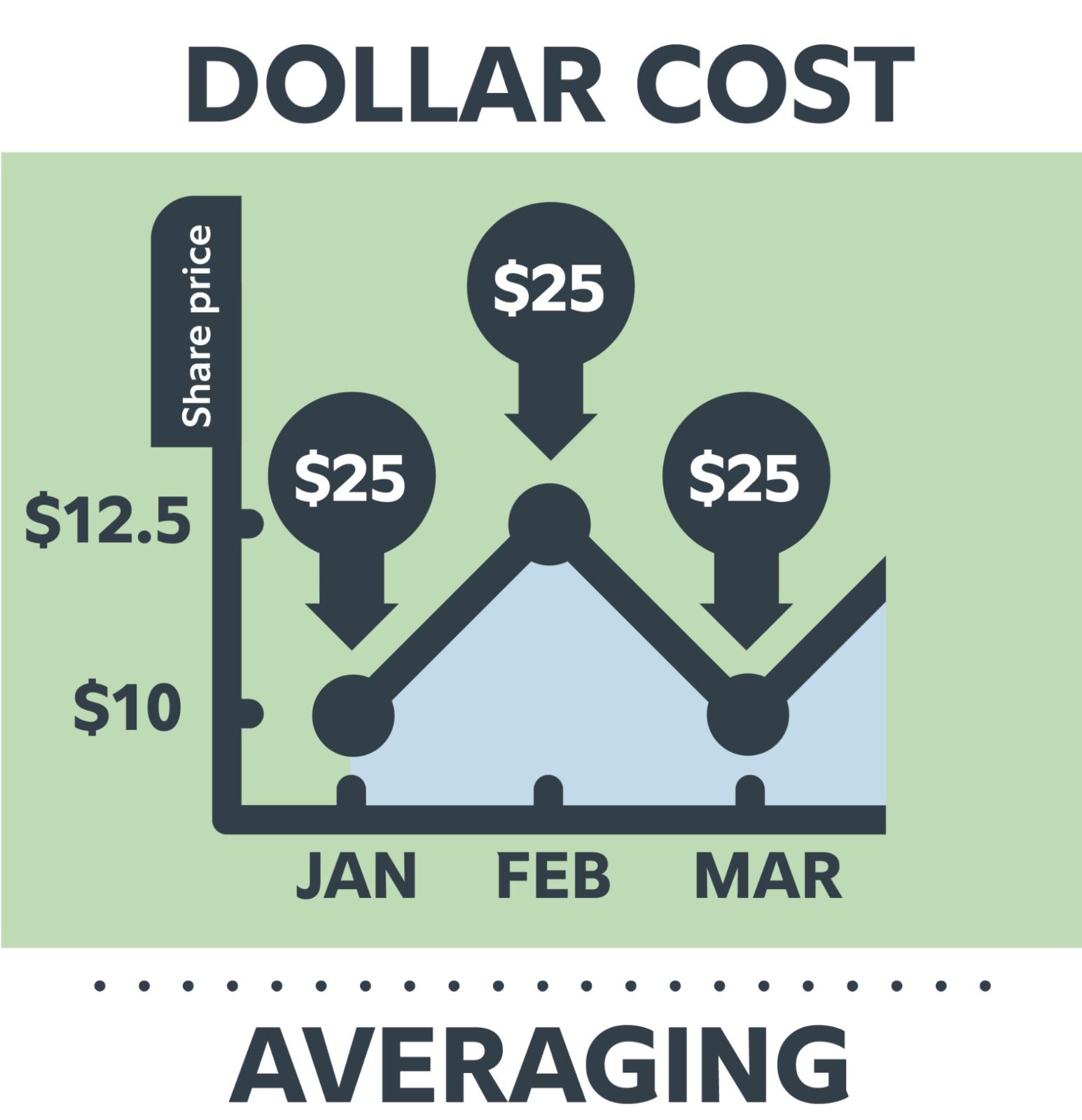

Whether you plan to let your bonds mature or sell them to make a profit, “ladder” your bond exposure (buy bonds that mature across a span of years) so you can reinvest income as they mature and diversify the interest-rate risk in your portfolio. - Consider dollar-cost averaging

Dollar-cost averaging is when you invest the same amount at regular intervals, regardless of market prices. This approach helps reduce market timing risk and keeps you consistently invested. - Rebalance for inflation protection

Monitor and adjust your portfolio periodically to keep your goals on track and hedge against inflation.

Shows the practice of investing the same amount in regular intervals,

regardless of the current market price

Source: Fidelity

Shows the practice of investing the same amount in regular intervals,

regardless of the current market price

Source: Fidelity

Common Mistakes to Avoid During Inflation

Even well-intentioned investors can make costly missteps during periods of inflation. Here are three common ones to avoid:

- Holding too much cash

An adequate emergency fund is important, but excess cash loses value quickly when inflation hits. - Relying solely on long-term bonds

They’re the most susceptible to inflation. Balance them with shorter-term bonds and other asset types. - Panicking during market corrections

A diversified portfolio can withstand market fluctuations. Panic selling locks in losses and jeopardizes long-term plans.

We’ve seen how these mistakes can quietly weaken a retirement plan, reinforcing a key lesson: a diversified, well-managed portfolio is your retirement plan’s best defense against inflation and volatility.

Conclusion

Inflation is unavoidable, but it doesn’t have to undermine your retirement. With the right mix of diversified bonds, stocks, and real assets – and a disciplined approach during inflationary periods – you can protect the retirement you’ve worked hard to build. The key is ensuring your plan reflects your goals, time horizon, and comfort with risk.

At Toberman Becker Wealth, we help you see the full picture, align your investments with your goals, and build a portfolio that withstands inflation.

If you are looking for an investment advisor to help you build a sound strategy to support your long-term retirement goals, book a meeting or give us a call.

Inflation & Retirement: Frequently Asked Questions

Craig Toberman is a Partner at Toberman Becker Wealth – a fee-only, fiduciary financial advisor based in St. Louis. He assists families and businesses with strategic financial planning and long-term wealth management. He has over a decade of experience in financial services and has crafted custom financial plans for hundreds of families and businesses.