Business Financial Planning Services Include:

• Estate planning

• Succession planning

• Business value growth planning

• Financial statement analysis

• Financial technology strategic consulting

• Accounting policies and procedures design

• Merger & acquisition (M&A) analysis and consulting

• Accounting and finance staff training and onboarding

A succession plan is key to growing your company’s value, ensuring a smooth transition, and helping you make your next steps more intentional.

At Toberman Wealth, our focus is on helping business owners grow, manage, and transition their businesses. If developing a succession plan is something you need to start considering, we recommend focusing on these seven building blocks first:

1. Set a Realistic Departure Timeline

2. Know What the Business Is Really Worth

3. Identify a Strong Successor

4. Cultivate Steady Leadership

5. Keep Your Employees Bought-In and Growing

6. Consider the Types of Business-Sale That Make Sense

7. Work With a Team of Specialists

Creating an airtight succession plan for your small business is where we shine. We’re here anytime to help you navigate the ins and outs of a transition. Our goal is to make you feel confident in your and your business’s next steps.

Exit Planning Takes Work, And We Can Help.

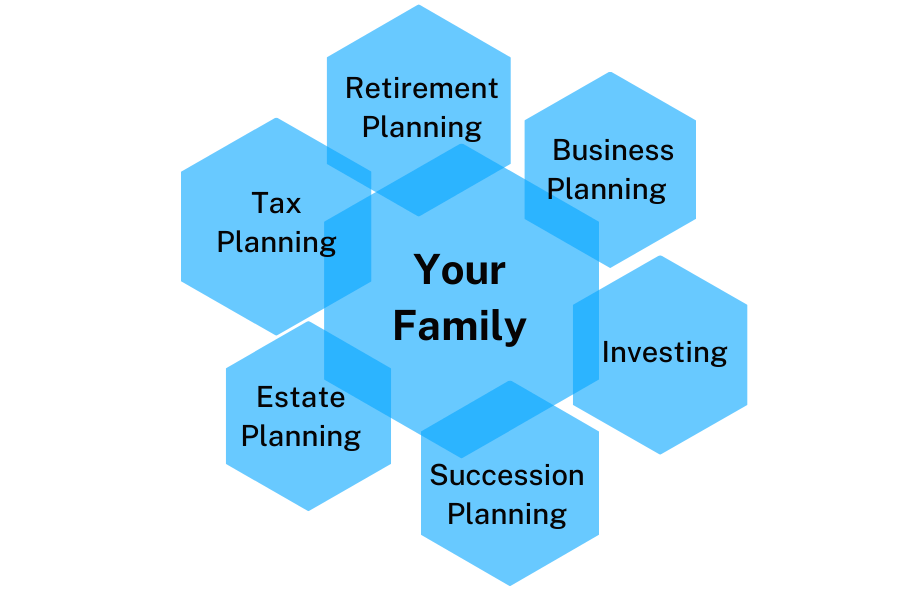

We have seen second or third-generation siblings fight over the family business (or land) due to succession planning that was delayed too long. Pushing off the “hard conversations” around the estate, tax, business, and succession planning can mean the difference between the success or failure of a family business.

Furthermore, it can also negatively impact the personal relationships, health, and financial well-being of all parties involved.

It is crucial to build a team and work with a competent lawyer, tax professional, and financial planner when it comes to exit planning for small business owners. To prepare for your future, we meet with you, your family, and your management team to create a strategy that truly supports your vision.