Retirement Planning Goals by Age: What to Focus on in Your 50s, 60s, and Beyond

The leap from working to not working – better known as retirement – feels daunting to many Americans. Though some have big dreams of traveling the world during retirement, most have humbler goals. As a fee-only financial advisor and retirement planner, my clients looking to retire are most concerned with:

- Reducing the amount of taxes they’ll have to pay

- Ensuring their healthcare expenses will be fully covered

- Making sure their immediate family, especially their spouse, is taken care of

- Enjoying retirement without stressing about day-to-day expenses

Whether you’re in your 50s or 60s, retirement planning looks a little different at each stage. This guide breaks down what to prioritize in every decade so you can retire confidently and stress-free.

Retirement Planning in Your Early 50s: Building Momentum and Purposeful Habits

Retirement Planning in Your Late 50s: Preparation and Financial Positioning

Retirement Planning in Your 60s: Transition and Decision-Making

Retirement Planning in Your 70s & Beyond: Preservation and EnjoymentYour Early 50s: Building Momentum and Intentional Habits

You’ve built a career, maybe raised a family, and gained financial traction. Now, it’s time to turn momentum into mastery. In your Early 50s, every smart move compounds, especially when it comes to retirement planning. The choices you make today will define your financial freedom and confidence tomorrow.

- Strengthen Your Savings Foundation

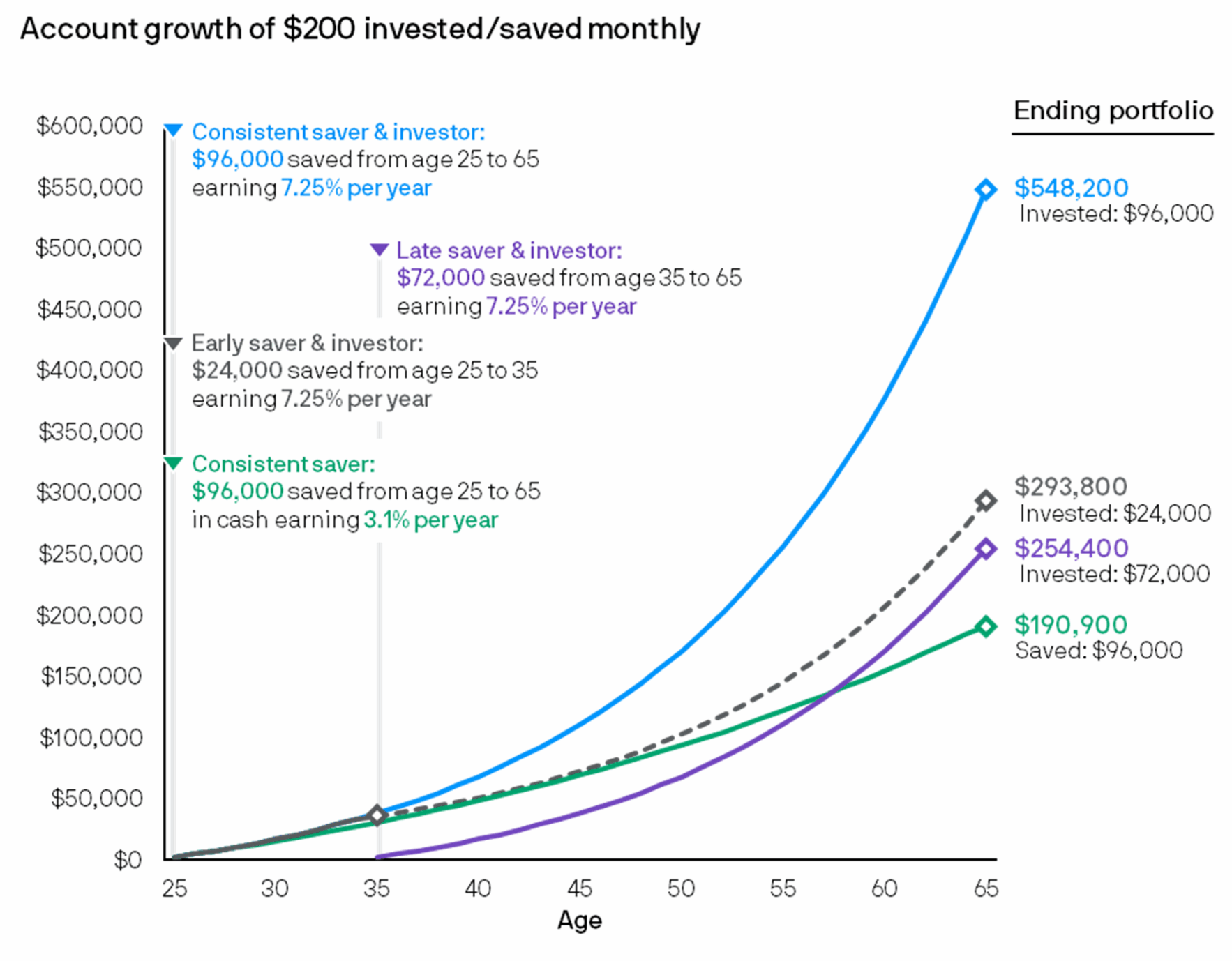

Many of our clients in their early 50s are in the “sweet spot” for savings and investing. They’ve established their careers, paid down their debt, and still have plenty of time to grow their portfolios.

A visual comparison showing the long-term benefits of early saving and investing compared to delayed investing.

Source: J.P. Morgan Guide to Retirement

- Now is a great time to talk with your advisor about how to:

- Establish or refine a long-term savings strategy

- Determine your risk tolerance and investment appetite

- Pursue growth opportunities that align with your comfort zone and time horizon

- Create Smart Tax and Investment Habits

Considering the long-term tax implications of your savings and investment strategies is key to making informed financial decisions. Though the topic can be complex and is subject to change, creating smart tax habits and modifying your strategy as your financial situation and tax laws change will help you:- Take advantage of new opportunities

- Mitigate potential risk

- Plan for a financially secure future

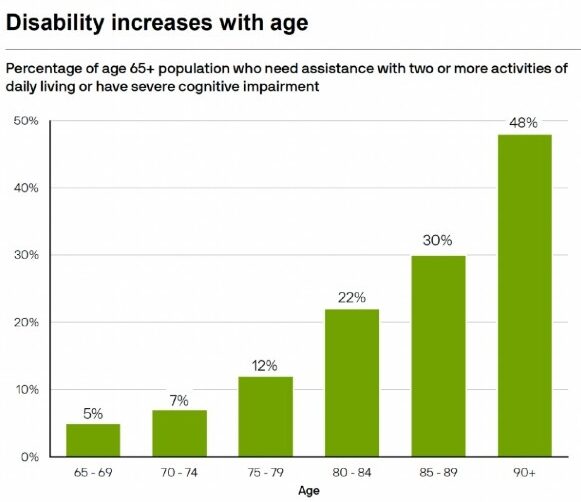

- Begin Healthcare and Risk Planning

Healthcare is expected to be both the fastest-rising expense and the most significant financial unknown. Early preparation is key to preventing these costs from derailing your plan. Consider overestimating expenses, for example, assuming twice the rate of inflation, to stay ahead and protect your long-term savings. Incorporating healthcare and potential long-term care costs into your overall financial strategy brings added peace of mind.

A chart demonstrating the shift into long-term care over different stages of life.

Source: J.P. Morgan Guide to Retirement

- Clarify Your Retirement Planning Goals

Understanding key components of your assets, income sources, and timeline will help you make confident decisions and build a retirement plan that reflects your unique goals. Communicate those goals clearly with your advisor and spouse to stay aligned and on track.

Your early 50s are all about setting the stage for retirement planning. In your later 50s, you’ll begin fine-tuning this plan with tangible projections, setting yourself and your loved ones up for lasting financial success.

In your early 50s, focus on building strong financial habits and clarity. The earlier you start aligning your savings, taxes, and goals, the smoother your path to retirement will be.

Your Late 50s: Preparation and Positioning

Your late 50s are about setting yourself and those you love up for success. This latter part of the decade is for getting organized, fine-tuning your finances, and preparing your plan for the next stage of life.

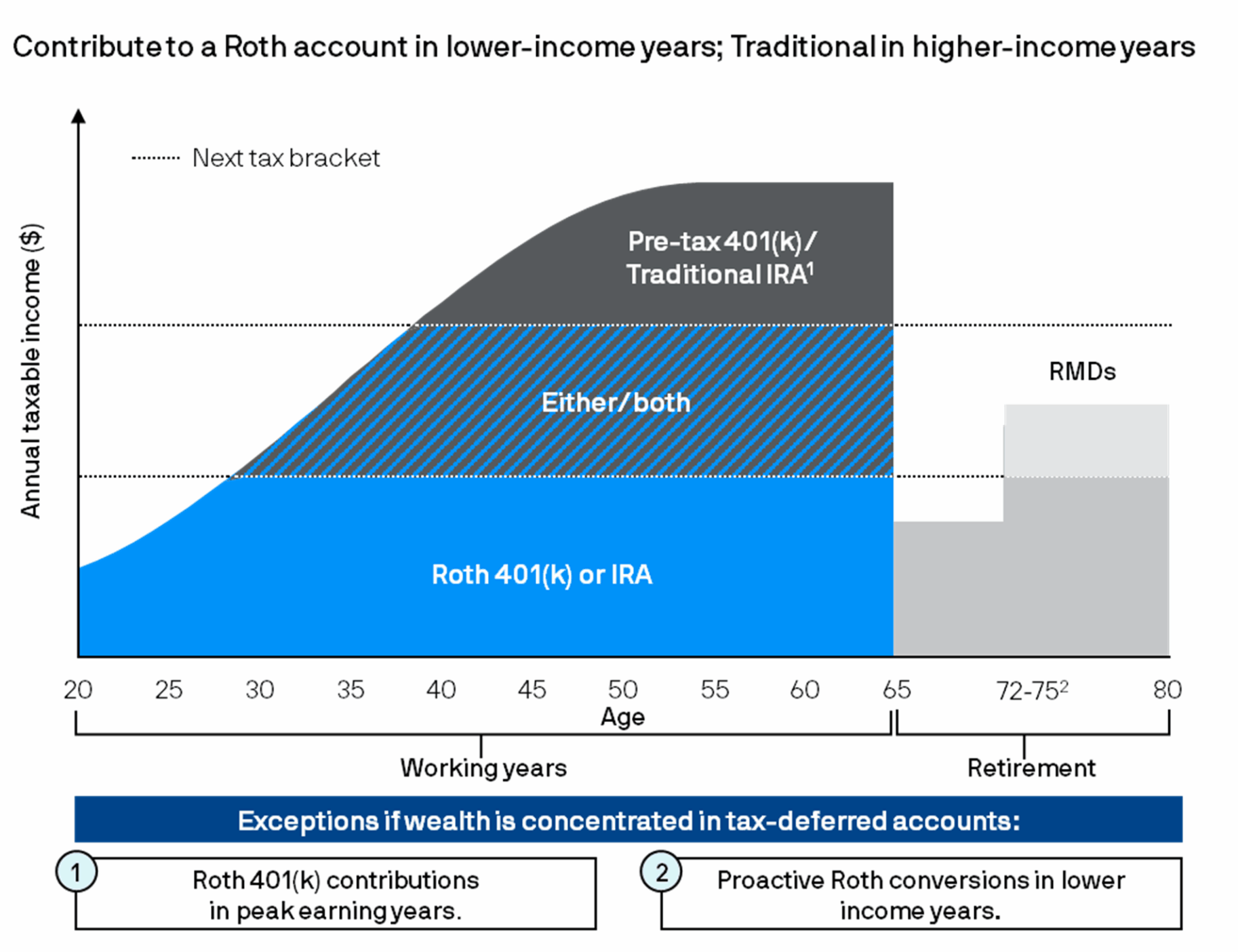

- Reduce Your Future Tax Burden

Form a long-term strategy to minimize taxes leading up to and during retirement. Review your investments, retirement accounts, Social Security, and annuities to understand how they’ll affect your taxable income. Compare withdrawal strategies and consider how tax brackets may shift over time to maximize after-tax income.

Chart illustrating the changes in the taxable income of a Roth account at different stages of life.

Source: J.P. Morgan Guide to Retirement

- Get Organized

Set clear goals, gather key documents, and prepare for major financial decisions. Working with a trusted financial advisor can bring clarity and reassurance. Ask questions, voice concerns, and discuss fears openly. It’s natural to feel apprehensive about retirement, but understanding your finances will give you peace of mind. - Start Healthcare Projections

Begin projecting how healthcare costs will evolve over the next few decades. Build a 40-year model assuming costs rise 5% or more annually, then adjust your financial plan accordingly to protect your long-term security. - Legacy Foundations

Compile an organized inventory of your assets, investments, and key information, and share it securely with a trusted family member. Have open, honest conversations with beneficiaries to ensure your legacy plan is clear and free of future surprises.

In your late 50s, your goal is to position yourself. Build systems, understand your numbers, and anticipate costs before you retire.

Toberman Becker Wealth will help you build the retirement you’ve dreamed of.

From tax-efficient withdrawal strategies to long-term legacy building, we’re here every step of the way.Your 60s: Transition and Decision-Making

Your 60s are about turning plans into action. This is the decade when you move from saving to spending, from preparing to living. The decisions you make now will shape your comfort, security, and peace of mind for the years ahead.

- Execute Your Tax Strategy

Now’s the time to put your tax-optimized withdrawal plan into motion. Withdraw funds from your accounts strategically to maximize after-tax income and take advantage of new tax opportunities that arise when you turn 65.Stay informed about evolving tax laws, economic shifts, and legislative changes that can impact your strategy. Regular check-ins with a financial advisor can help you adjust in real time, avoid penalties, and make the most of every dollar you’ve earned.

- Make Critical Healthcare Choices

Around age 65, critical and often permanent decisions need to be made. Seek the help of a trusted Medicare advisor who can guide you through the process. They can offer clarity on the complexities of Medicare – its parts, coverage options, and enrollment timelines – so you can make confident, informed decisions.Smart healthcare decisions go beyond your policy. True health is built through consistent habits. Regular exercise, a balanced diet, and preventative care to help manage costs, maintain well-being, and allow you to enjoy the retirement you’ve planned for.

- Revisit Family and Legacy Plans

Seek guidance from financial advisors, estate planning attorneys, and other professionals with expertise in legacy planning. They can help you navigate complexities and ensure that your loved ones’ future is secure, while providing guidance and support if it’s needed later.Estate taxes can reduce the value of a deceased spouse’s estate. In the US, the federal estate tax is a tax imposed on the transfer of a deceased person’s assets to their heirs or beneficiaries. While Missouri doesn’t have an estate tax, federal estate taxes are constantly changing and must be a part of financial planning discussions.

Work closely with your planner to ensure you’re thinking about your legacy, while also leaving enough in your nest egg so you never have to worry about money.

- Stay Stress-Free

As your goals evolve, so should your investment strategy. Revisit your portfolio to confirm it still aligns with your risk tolerance, timeline, and retirement vision. Collaborate with your advisor to make thoughtful, disciplined decisions and establish a long-term plan for how your investments will be managed in the years to come.Equally important, communicate openly with loved ones. Clear conversations today ensure your wishes are understood, eliminating uncertainty and allowing you to focus on what truly matters.

Your 60s are the decade to step into retirement with clarity and peace of mind, confident in the plan you’ve built and excited for the freedom ahead.

Your 60s are a decade of action. You’re transitioning from saving to spending, so your decisions now will define your comfort and security for decades to come.

Your 70s and Beyond: Preservation and Enjoyment

Your 70s are about maintaining your quality of life, protecting your wealth, and enjoying the retirement you’ve worked so hard to create. This is the time to preserve what you’ve built, find joy in what you’ve achieved, and focus on the people and passions that matter most.

- Ensure Income Stability and Minimal Stress

Keep an open dialogue with your loved ones and your financial advisor to ensure your plan continues to support your goals. Together, review your income sources, spending needs, and savings strategy to maintain your standard of living and enjoy lasting financial peace of mind.Regular check-ins help you stay flexible and ready to adjust to changes in your health, the economy, or lifestyle, while ensuring you continue to live comfortably and confidently.

- Manage Long-term Care and Health Costs

Healthcare remains one of the most significant expenses in retirement, so revisit your long-term care and medical cost projections regularly. If you’ve saved more than needed, consider reallocating those funds toward personal goals, travel, or family support. If costs are higher than expected, work with your advisor to rebalance your plan while protecting your overall financial security.Proactive planning ensures that your health and comfort remain priorities, allowing you to focus less on logistics and more on living fully.

- Leave Your Legacy

Your 70s are also a time to shape the impact you’ll leave behind. If your resources exceed your own needs, consider ways to share your success and strengthen your family’s future.- Open a 529 Plan

Contributing to a 529 plan can help future generations pursue higher education. The funds grow tax-deferred, and qualified withdrawals are free from federal income tax, resulting in a meaningful investment in your loved ones’ futures. Organize Some Strategic Gifting

Create a long-term giving plan that supports the charitable causes and organizations that reflect your values. With the right strategy, your generosity can provide tax benefits while making a powerful difference in the community.- Invest for Future Generations

For assets intended for your heirs, consider introducing modest, strategic risk to long-term investments (those with a 30- to 50-year horizon). This approach can create opportunities for higher returns and long-term wealth growth. Work with your advisor to explore strategies like tax-loss harvesting to enhance future outcomes.

- Open a 529 Plan

You’ve done the hard work of saving, planning, and preparing. Now, your focus can shift to what truly matters: enjoying the retirement you’ve envisioned, sharing your wealth and wisdom, and leaving a legacy that reflects your life’s purpose.

In your 70s and beyond, your focus shifts to maintaining peace of mind; enjoying your retirement, managing risk, and leaving a legacy.

Bringing It All Together: Your Decade-by-Decade Path to Retirement Success

By approaching your retirement planning decade by decade, anticipating what’s ahead, and adjusting as needed, you can retire confidently and enjoy the life you’ve worked hard for.

Toberman Becker Wealth is a fee-only, independent fiduciary based in St. Louis. Whether starting to invest for retirement in your 50s or actively planning for retirement in your 60s, we help people nearing a transition build a resilient retirement plan. We always operate in our clients’ best interests, and our top priority is to help you live comfortably now without sacrificing your financial future later.

If you ever have a question about your retirement planning strategy, feel free to book a meeting or give us a call.

Michael is a highly knowledgeable and experienced partner at Toberman Becker Wealth in St. Louis. With his expertise in investment management, behavioral finance, and retirement planning, Michael is dedicated to providing his clients with the best financial guidance possible.

Having worked with clients on complex estate planning and developing investment strategies for a team of advisors, Michael’s experience spans across various areas of financial planning. What truly sets him apart is his unyielding desire to acquire knowledge for the betterment of his clients. At Toberman Becker Wealth, this commitment to continuous learning is the foundation upon which exceptional client experiences are built.

Michael earned a Bachelor of Science degree in Finance and Banking from the University of Missouri – Columbia. Additionally, he holds designations as a Chartered Financial Analyst (CFA) charterholder and Certified Financial Planner (CFP).

Beyond his professional achievements, Michael enjoys a fulfilling personal life in St. Louis. Living with his wife, Lindsey, and their beloved dog, Birk, he finds joy in activities such as golfing together and exploring local restaurants.