Top 5 Ways to Maximize Your Social Security Benefits

Planning for retirement requires careful consideration of every source of income. For many retirees, Social Security benefits significantly impact the retirement lifestyle, providing monthly income during the golden years. Social Security benefits safeguard financial stability and peace of mind when appropriately maximized.

As a fee-only financial advisor, I often see how drastically a Social Security strategy can alter a client’s overall retirement plan. In this article, I share essential strategies to optimize your Social Security strategy.

1. Try to Delay Benefits As Long As Possible

Choosing the right time to collect Social Security benefits is crucial to properly managing your future cash flows in retirement. Retirees can start claiming benefits anytime between the ages of 62 and 70, but those who wait until age 70 can maximize their earning potential and receive up to approximately 120% of the full Social Security benefit.

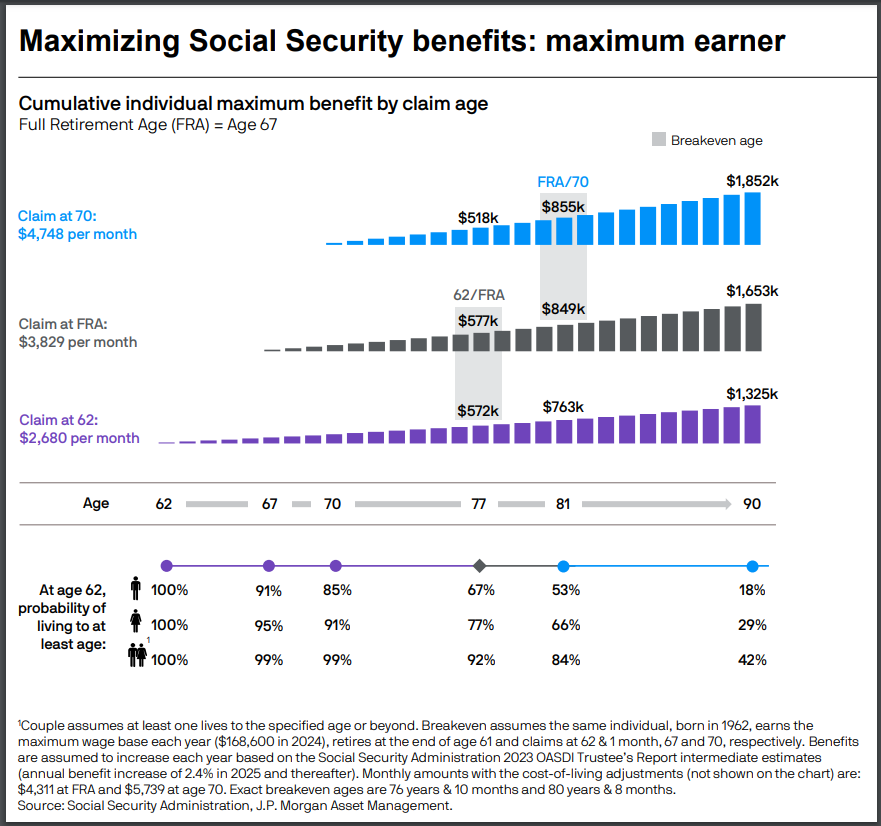

The cumulative maximum benefit for an individual varies by claim age. An individual who claims benefits at Full Retirement Age will not break even with the delayed option until age 81.

Source: 2023 JP Morgan Guide to Retirement

Here are three options to consider:

- Early Retirement | Ages 62-66

- Benefit Reduction: 25-30%

- Sample Benefit: Amount: $2,100/month

This reduction leads to a cumulative loss of $194,400 over an average 18-year retirement or $324,000 over a 30-year retirement compared to claiming full benefits.

- Full Retirement Age (FRA) | Ages 66-67*

- Full Benefit Amount

- Sample Benefit: $3,000/month

Your full retirement age (FRA) is determined by your birth year: 66 for those born between 1943 and 1954 and 67 for anyone born in 1960 or later.

- Delayed | Ages 68-70

- Benefit Increase: +7-8% per year after FRA, up to a total 30% increase by age 70.

- Sample Benefit: $3,900/month

The boost translates to an additional $194,400 over an 18-year retirement or $324,000 over 30 years compared to claiming full benefits at FRA.

Use our Social Security Benefits Calculator to input your data and receive a personalized estimate tailored to your situation.

Generally, relying on other liquid assets until age 67 is the best way to maximize your benefits. However, your retirement strategy should align with your unique circumstances and risk tolerance. For example, if you are dealing with serious health concerns or are worried about Social Security’s future, claiming benefits early at 62 could be the right decision.

2. Understand Spousal & Survivor Benefits

Social Security offers spousal and survivor benefits that can significantly impact household income for married retirees. Strategic coordination of benefit claims between spouses can meet immediate income needs while also maximizing the benefits from delaying collection.

- Spousal Benefits

If you are 62+ years old and your higher-earning spouse has started collecting their benefits, you may be eligible to receive up to 50% of their full retirement benefit.If your marriage lasted at least 10 years, you may still qualify for spousal benefits even if divorced. - Survivor Benefits

When a spouse passes away, the surviving spouse can often receive their benefits OR the deceased spouse’s, depending on which is higher.

3. Manage Retirement Income Levels to Avoid Tax & Medicare Implications

Retirees with higher income levels can be subject to federal taxation on Social Security benefits and increased Medicare Part B & D premiums. Up to 50-85% of your benefits may be taxable if your provisional income exceeds $25,000 or $32,000 for single and joint filers.

Depending on your situation, we often recommend the following strategies to manage retirement income levels:

- Execute a Roth Conversion

Convert traditional IRA funds to a Roth IRA before collecting Social Security benefits to reduce future taxable income. - Invest in a Treasury Bond Ladder

A diversified bond portfolio that uses a laddered approach with staggered maturity dates helps ensure that a retiree receives principal reimbursements on a set schedule, covering retirement expenses without unexpectedly crossing a higher income threshold. At Toberman Becker Wealth, we design bond ladders in 8-year increments to safeguard against economic risk factors. We often curate the schedule so clients begin the year with bond maturity cash payouts every January.

4. Report Income for at Least 35 Years

Your Social Security benefit is calculated based on your highest 35 years of earnings. If you report income for fewer than 35 years, zeros will be averaged into your calculation, drastically reducing your benefit amount.

- Track Your Earnings Record

Social Security statements are available online at ssa.gov. Review your record to verify the accuracy of your earnings history and to inform retirement timing decisions. - Consider a Part-Time Exit Strategy

If you’re eager to retire but have less than 35 years of earnings, even part-time income can boost your average and improve your benefit calculation by replacing zero-earning years.

5. Prepare for the Unknown Future of Social Security

Though recent projections suggest that Social Security funds will be depleted between 2033 and 2035, our view is that the government will likely opt to make changes to payroll deductions or retirement benefits rather than face the litany of negative consequences that would arise if Social Security and Medicare were to lose funding.

Still, reliable retirement plans depend on reliable analysis and evaluation of all known risk factors, and potential changes to Social Security represent a legitimate risk factor for some retirement portfolios.

Here’s how to prepare:

Stress Test Social Security Benefits. Determine the likelihood that your portfolio would be able to support your retirement lifestyle in the event of a significantly reduced Social Security benefit. Retirement modeling software can generate a clear snapshot of your asset mix, demonstrating how much your retirement budget depends on monthly Social Security income.

Request a retirement model that forecasts EACH possible change to Social Security, including:

- Reduced benefits

- Increased tax rates

- Dissolution of benefits

- Reduced cost of living adjustments

- Reduced inflation adjustments

How Do Financial Advisors Help Develop a Social Security Strategy?

Maximizing your Social Security benefits requires thoughtful planning and a clear understanding of how the system works. While a basic benefits calculator can provide an estimate, a financial advisor uses expertise and advanced tools to account for the unique details of your retirement plan.

A comprehensive analysis by a financial advisor often includes cash flow projections (to track income and expenses), portfolio return simulations (to estimate investment growth), spousal benefit optimization, and fixed income estimates. These factors are combined to create a customized strategy that helps you make confident, informed decisions about your financial future.

About Us

Toberman Becker Wealth is a fee-only, independent fiduciary firm based out of St. Louis. Whether starting to dream about retirement in your 50s or actively planning for retirement in your 60s, we can help you formulate a resilient retirement plan.

We always operate in the best interests of our clients. Our top priority is helping you live comfortably now and in the future with a substantial savings strategy.

If you’re looking for an investment advisor to help you build a diversified retirement plan that ensures comfort and peace of mind, please book a meeting or give us a call.

Social Security Benefits FAQ

Social Security is a U.S. government retirement benefit funded by FICA (Federal Insurance Contributions Act) payroll deductions. About 15% of your income is contributed to provide future financial support during retirement. In traditional employment, you pay half; your employer covers the other half.

Social Security is a U.S. government retirement benefit funded by FICA (Federal Insurance Contributions Act) payroll deductions. About 15% of your income is contributed to provide future financial support during retirement. In traditional employment, you pay half; your employer covers the other half.

Your Social Security benefit is determined by the FICA taxes you paid throughout your career, with the calculation based on your 35 highest-earning years. If you worked fewer than 35 years, the remaining years are filled in as zeros, which can lower your average. The more you earn (up to the annual cap) and the longer you work, the higher your potential benefit.

The full retirement age (FRA) is typically 67, but you also have the option to start receiving benefits as early as 62 or as late as 70. The age at which you start collecting Social Security impacts your benefit amount. To encourage delaying, the government increases your monthly payment amount every year that you delay benefits up until age 70.

- Early Retirement (Ages 62-66): 25-30% Reduced benefit

- Full Retirement Age (Ages 66-67+): Full benefit

- Delayed (Ages 68-69): 7-8% Benefit increase per year

- Delayed (Age 70): 130% Benefit increase

The ideal time to collect Social Security depends on your unique situation. These questions can help you decide what’s best for you and your family:

- Are you still working or planning to work beyond full retirement age?

- Do you have other income sources or assets to cover your expenses until you begin collecting?

- Do you have any serious health concerns that may affect your decision?

- What is your life expectancy, and will your savings last throughout retirement?

Craig Toberman is a Partner at Toberman Becker Wealth – a fee-only, fiduciary financial advisor based in St. Louis. He assists families and businesses with strategic financial planning and long-term wealth management. He has over a decade of experience in financial services and has crafted custom financial plans for hundreds of families and businesses.