The Top 8 Questions About Retirement Planning Answered

Throughout my time as a fee-only financial advisor, I’ve found that I’m asked the same questions about retirement planning over and over again. These range from the obvious (will I have enough money to retire?) to the more complicated (how do I handle taxes after I retire?). More often than not, these questions come from a place of fear.

It’s good to ask questions, but it’s not good to be scared. So what I’ve done is compiled a list of the top 8 questions I get asked about retirement planning, and provided answers. You can trust these answers because they’ve been provided by a fee-only financial planner (and not someone affiliated with a brokerage that’s interested in selling you their products).

Read on to find the answers to your questions about retirement planning, and hopefully get some peace of mind.

JUMP TO:

1. How much money do I need to retire?

This is by far the most common question that I’m asked since it tends to generate the most fear in my clients. But this is a fairly easy question to figure out. To do so, consider these four areas:

- Establish lifestyle goals

Consider factors such as where you want to live, if you want to travel, and if you plan on working to generate extra income in your retirement years. Once you have an idea of how you want to live when you reach financial independence, you can “reverse engineer” a financial strategy that works towards those goals. This is a tailored and specific process and will not align with that of your parents or best friend, which can be intimidating to a lot of people.

- Take stock of what you’re currently spending

If you’re unsatisfied with your current projection, start documenting what you’re spending. You can use a budget worksheet to track your incoming and outgoing expenses and although your spending may fluctuate slightly, it can still be a good indicator of what your baseline retirement expenses might look like.

- Identify potential deficits

Once you have a ballpark figure in mind, it’s helpful to add up all your savings and identify potential deficits. Here are some questions to ask yourself about your retirement savings:

– Is my 401(k), IRA, and/or brokerage account on track to meet my retirement income goals?

– Am I maxing out my contributions or can I contribute more to these accounts?

– Are my portfolio allocations still aligned with my risk tolerance, timeline – toward retirement, and overall goals.

– What fixed income can I rely on in retirement? Be sure to include the earnings collected through Social Security, pension plans, and annuities. - Consider your health and longevity

Determine how long your “nest egg” will need to sustain you. For example, if you have a long family history of people living past 100, the traditional 30-year timeline may fall short – especially if you plan on retiring early.

2. How do I spend my retirement savings?

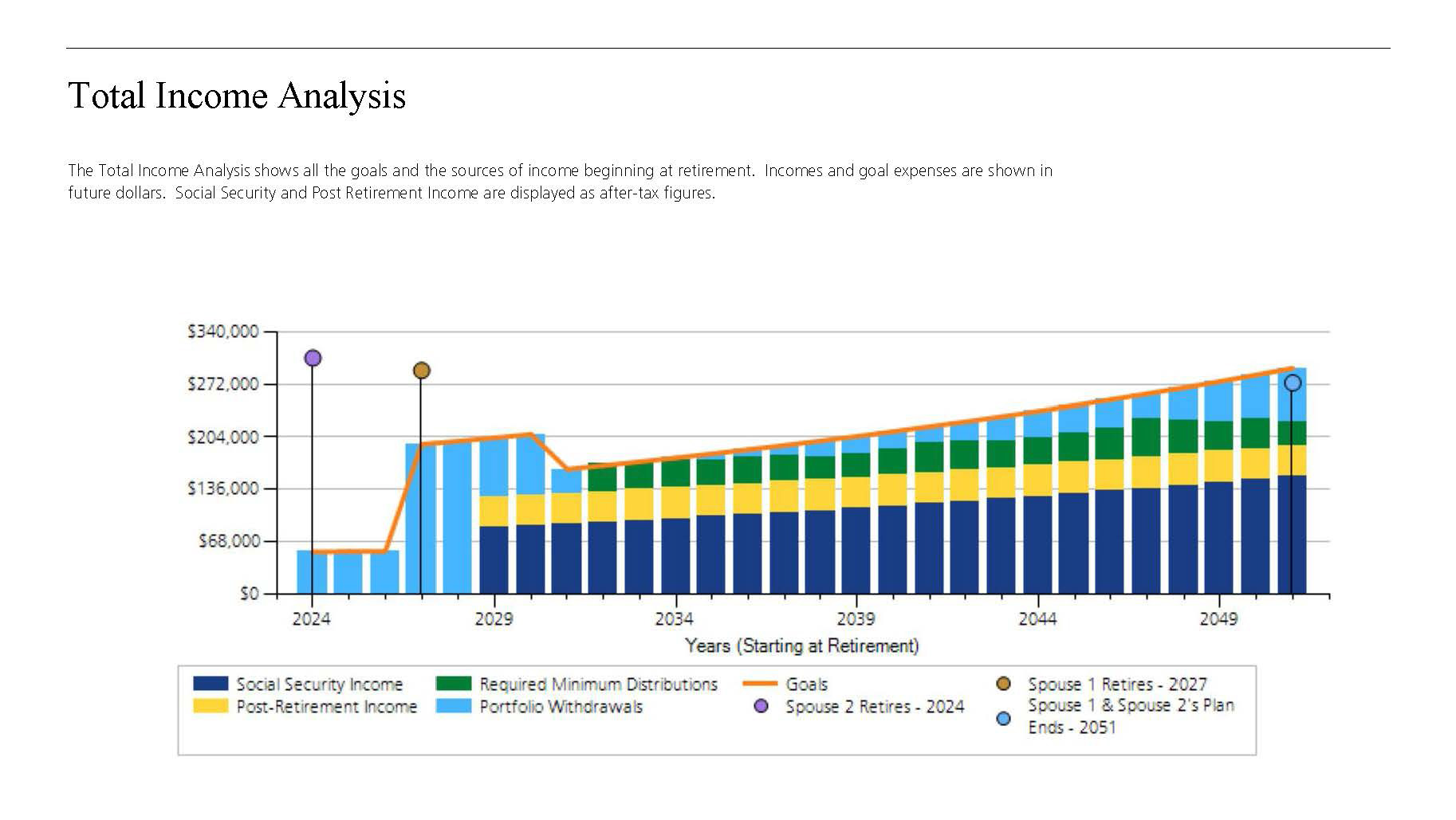

Without a W-2 income (i.e. a paycheck), many retirees are worried about how they will access money in retirement. As our client’s inch closer to retirement, we work with them to create a withdraw strategy. A withdraw strategy is used to determine which accounts to pull money from and when. This is done in a way that balances current spending with the potential for future investment growth.

Once a withdraw strategy is in place, you’ll know what to expect when retirement comes. For example, if you were used to living off $5,000 a month while employed, we can plan for a scheduled deposit that mimics the paycheck you received from an employer – thus resulting in a seamless transition into retirement.

3. How can I manage my taxes after I retire?

Considering taxes ahead of your retirement is vital to the success of your long-term financial goals. To start, it’s important to learn how your different withdrawals and income will be taxed overtime. Income sources include investments, retirement accounts, Social Security, pension plans, and annuities.

To ensure that enough money is set aside for your yearly tax bill, we use a withdrawal strategy. The withdrawal strategy organizes the different income sources and considers their varying tax treatment, managing them in a way that minimizes tax payouts. Our role as your financial advisor is to help retirees leverage ongoing tax opportunities such as Roth conversions, tax loss harvesting, and charitable giving. We use our expertise and creativity to keep more of your money working for you during retirement.

4. How do I make sure my medical expenses are paid in retirement?

Healthcare is one of the biggest expenses to account for in retirement. A study from the Employee Benefit Research Institute estimates that a couple could need as much as $360,000 saved by the age of 65 to cover their healthcare expenses during retirement.

One option I recommend my clients consider is to invest in a Health Savings Account (HSA). An HSA works similarly to a retirement 401(k), but the money after 65 can be withdrawn without penalty and tax-free to pay for qualified medical expenses. The plan also comes with incentives such as tax-deductible contributions, tax-free withdrawals for medical expenses, and tax-deferred growth on your investments.

I also remind my clients that though they can qualify to receive Medicare at 65, it’s important to understand what it does and doesn’t cover. If the plan falls short of your needs, it could end up being costly. Though there are options to purchase added insurance to strengthen the plan – it’s important to weigh your options and see what will benefit your unique situation best.

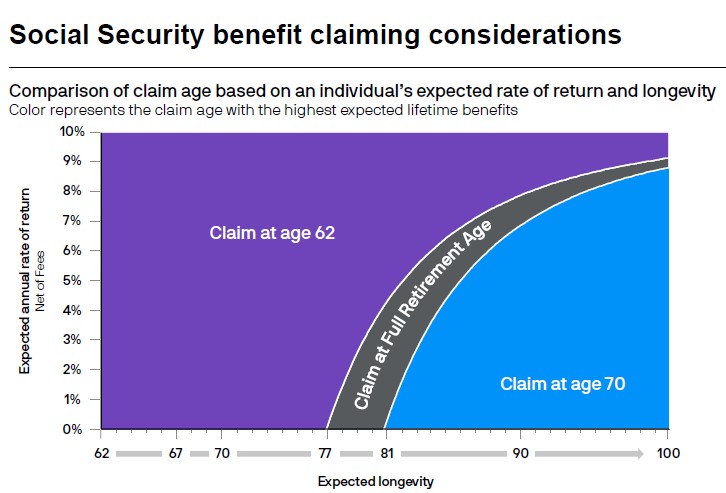

5. When should I claim social security?

For many people, the best option is to wait until your full retirement age or 67 (or beyond) to redeem your Social Security benefit. Though you can claim as early as 62, you will be penalized by receiving a reduced benefit, ultimately costing you and your spouse, more long-term. If you wait until you’re 70, you could substantially increase the payment you receive for the rest of your life. After 70, there is no incentive to wait. Of course, this type of decision is highly individualized.

Source: J.P. Morgan Guide to Retirement

6. If I work longer (or part-time) in retirement, would it be beneficial?

If you’re in good health, it may be a good idea to work past retirement age. In fact, it could dramatically improve your chances of retirement success. Working, even in a part-time position can:

- Improve Social Security and pension calculations.

- Delay the need to initiate your Social Security or pension income.

- Allow you to save more into tax-advantaged vehicles.

Though many people prefer not to, it’s good to know there are options if needed.

7. What do I need to include in my estate plan?

Constructing a comprehensive estate and legacy plan is important for every retiree, no matter what your finances look like. By formally documenting your plans, you can ensure that your assets, memories, and legacy are seamlessly transferred in the ways you intended.

You want to work with a qualified estate attorney to draw up your plan, and I recommend working with a financial advisor who will work with your attorney to make sure documents are intact and due diligence has been completed. An attorney and financial advisor should assist you in coordinating your estate planning paperwork for financial soundness, including:

- Wills

- Trusts

- Beneficiaries on all accounts

- Powers of attorney

- Medical directives

- Estate executors

- and more

8. Should I work with a financial advisor in retirement?

We believe the best way to make sure you’re secure in retirement is to work with a professional that understands how the markets work, how to create a customized budget, and can make sure his or her clients are on top of the moves they need to make for financial stability.

However, it’s important to choose the right advisor. Someone who understands your unique situation, and then designs and manages a comprehensive portfolio customized to your goals.

Avoid working with any advisor who does the following:

- Rarely communicates with you

- Never or rarely answers your questions

- Can’t remember basic information about you (your spouse’s name; what you do for a living; if you have children)

- Works off commission

- Ignores your goals and instead encourages you to invest in their financial products

- Isn’t upfront about the fees they charge

- Doesn’t provide comprehensive reporting on at least a quarterly basis

- Can’t recommend other professionals to help provide a robust financial plan, like an estate attorney, CPA, or insurance professional

Retirement planning can be a scary venture, and a journey no one should walk alone. As you can see through the common questions raised above, there are many factors that need to be addressed for your retirement plan to maximize its benefits.

Toberman Becker Wealth is a fee-only, independent fiduciary firm based in St. Louis. We operate in the best interests of our clients, always. Our priority is to help you live comfortably now, without sacrificing your financial future later. Think of us as your retirement planning partner, helping you navigate your ideal life.

If there’s ever a question you have about your retirement planning strategy, feel free to book a meeting or give us a call.

Disclosure: Any mention of a particular security and related performance data is not a recommendation to buy or sell. The information provided on this website (including any information that may be accessed through this website) is not directed at any investor or category of investors and is provided solely as general information. Nothing on this website should be considered as personalized financial advice or a solicitation to buy or sell any securities.

Craig Toberman is a Partner at Toberman Becker Wealth – a fee-only, fiduciary financial advisor based in St. Louis. He assists families and businesses with strategic financial planning and long-term wealth management. He has over a decade of experience in financial services and has crafted custom financial plans for hundreds of families and businesses.