Why You Need a Retirement Income Distribution Plan

At Toberman Becker Wealth, we build retirement plans for our clients that focus on three main objectives:

- Making sure healthcare expenses are covered.

- Making sure living expenses are covered.

- Ensuring clients can pay for items that will actually let them enjoy retirement (e.g. travel, hobbies).

Saving for retirement is a big part of retirement planning, but many people ignore an important part of a retirement strategy: your Retirement Income Distribution Plan (RIDP).

Only looking at the money you’ve accumulated for your retirement can be a costly mistake. A strategic withdrawal plan in retirement can help you maximize the value of your retirement accounts, while minimizing costs, such as your tax liability.

In this article, I discuss the importance of a retirement income distribution plan, when to create one, and how to go about implementing one.

1. What is a retirement income distribution plan?

A RIDP is a thoughtful withdrawal strategy put in place to ensure you’re deploying your retirement savings in the most beneficial way possible and with the least amount of penalty. As you accumulate savings into your various retirement accounts, there are specific rules set in place to deter you from withdrawing your money too soon. If those rules aren’t followed, your premature withdrawals could bring hefty fines.

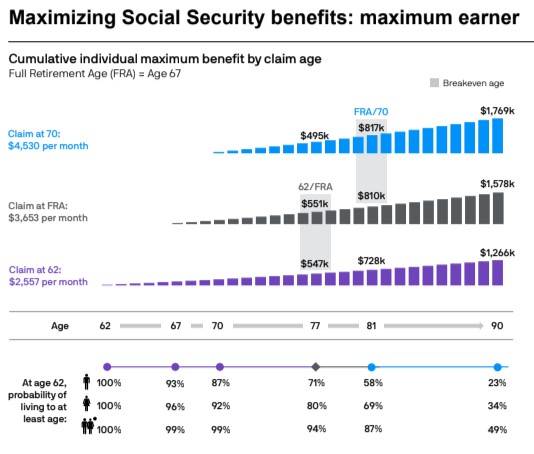

Social Security, for example, is notorious for having costly implications if you’re not aware of the rules and timelines. By creating a RIDP that factors in all your retirement goals, you’ll be able to further delay the start of the Social Security benefit with confidence (possibly all the way until age 70), resulting in bigger monthly checks throughout your golden years.

2. Why is a retirement income distribution plan important?

All of your retirement savings plans, whether they be corporate pensions or defined contribution plans such as 401(k) plans, 403(b) plans, and Individual Retirement Accounts (IRAs), have rules concerning timing.

For example, if you withdraw funds from a tax-advantaged retirement plan such as a 401(k) before you’ve reached the age of eligibility, a penalty can be incurred. Drawing money too early from a plan can take a substantial amount of money away from your savings and immediately remove money from the nest egg you’re depending on in your golden years.

3. Can a Retirement Income Distribution Plan recession-proof your retirement?

By creating a systematic set of strategies, you can avoid significant tax penalties and weather the storm through unpredictable events, helping to protect your savings.

Consider:

- Delaying the start of your Social Security payments as long as possible (ideally to age 70, if health permits) to maximize its benefits.

Source: J.P. Morgan Guide to Retirement

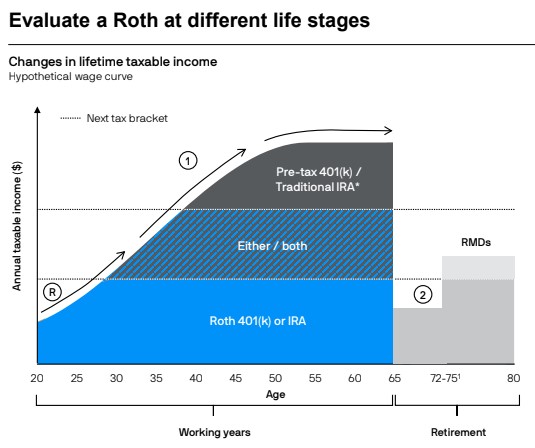

- Delaying the onset of income from traditional pension plans to keep income down during your early retirement years when it may make sense to perform Roth Conversions or strategically draw down tax-deferred account balances.

Source: J.P. Morgan Guide to Retirement

- Designing a plan that makes systematic withdrawals from your retirement accounts while factoring the risk of a market downturn.

- Using a portion of your savings to build a ladder of government bonds or CDs that can establish a reliable source of income.

- Investing for income – taking calculated investment risks for the opportunity to grow your savings and retirement income.

- Tracking and adjusting your living expenses to match your retirement income from all sources.

- Staying current with retirement issues – Be aware of trends, tax strategies, and new products (one of the many benefits of a trusted financial advisor).

4. When do you need to create and implement a RIDP?

You can create a RIDP at any time during the retirement financial planning process, but the very latest we would recommend is 5 years prior to your retirement. By having a plan in place ahead of time, you’ll be assured that you’re prepared before you need to start pulling from your nest egg.

5. How do you create and implement a RIDP?

Considering your current financial situation and how it aligns with your long-term goals is the first step in creating and implementing a Retirement Income Distribution Plan.

- Create financial goals for retirement and set a monthly budget.

Eager to spend time with your family or take your dream vacation? What does your retirement look like to you? Whatever retirement looks like to you, having a clear goal is an incentive for stowing away those savings.

The first step in our retirement planning process is understanding our client’s financial needs and retirement goals. After determining monthly expenses, we establish a budget that allows our client to strategically save for their retirement and develop a RIDP for when it’s time to start withdrawing.

-

Look at your current nest egg and how it’s working for you.

No matter what age you are, it’s always a good idea to keep your eyes on the future – preparing for those golden years. Ensuring that you have a pension, a 401(k), or an IRA that is building savings for your retirement is always a good idea.

At Toberman Wealth, we combine all our client’s assets under one umbrella if they aren’t already. Next, we work together to design a comprehensive portfolio that aligns with their risk tolerance. After a long-term plan is established, we revisit and reevaluate the plan adjusting when necessary – always keeping our client’s best interests in the forefront.

-

Engage in long-range planning.

Do you have a history of family members living well into their 90s? As people live longer, they need their money to last longer, too.

With our clients, we set a life expectancy of 95+ years for financial projection purposes. This ensures that we account for their needs and that their nest egg can sustain them throughout the entirety of their golden years.

-

Visualize those plans through a financial model.

Unexpected illness, a volatile market, or receiving a surprise inheritance. There’s no way to predict the future, but you can consider certain scenarios that may come up in those retirement years to help you prepare for all of life’s ups and downs.At Toberman Becker Wealth, we take into account varying factors such as healthcare and taxes (two of the biggest expenses in retirement). We also plan for unexpected inflation to ensure our client’s nest egg is there when they need it most. For example, we can see the benefits of getting ahead with tax payments so they can “settle up with Uncle Sam” earlier and lighten the tax burden late.

Once you determine a budget that considers your spending and income expectations, it’s time to develop a strategy that aligns with your best interests. If you have a quality and well thought-out Retirement Income Distribution Plan in place, you can:

- Realize more income from Social Security.

- Minimize total lifetime taxes paid.

- Maximize the savings you have in retirement.

- Get the most out of your life savings.

At Toberman Becker Wealth, we’re aware of the sacrifices that come when trying to build a comfortable nest egg. Whether you’re planning for retirement in your 50s or planning for retirement in your 60s, our primary concern is making sure that you get the most out of your retirement by maximizing the money you’ve worked so hard to save.

Book a call today to learn the benefits of creating a Retirement Income Distribution Plan for your retirement.

Disclosure: Any mention of a particular security and related performance data is not a recommendation to buy or sell. The information provided on this website (including any information that may be accessed through this website) is not directed at any investor or category of investors and is provided solely as general information. Nothing on this website should be considered as personalized financial advice or a solicitation to buy or sell any securities.

Craig Toberman is a Partner at Toberman Becker Wealth – a fee-only, fiduciary financial advisor based in St. Louis. He assists families and businesses with strategic financial planning and long-term wealth management. He has over a decade of experience in financial services and has crafted custom financial plans for hundreds of families and businesses.