Will Social Security & Medicare Run Out of Money? We Think It’s Unlikely.

The state of national finances significantly influences retirement planning decisions, and recent headlines about the fragile future of Social Security and Medicare are particularly unsettling. But how concerned should you really be?

Before making any changes to your retirement strategy, it’s important to consider the realistic implications of an insolvent Social Security system and assess the more probable scenario where the U.S. government will take steps to preserve Social Security by raising taxes or adjusting retirement benefits.

As fee-only retirement advisors, we closely monitor any developments that could impact the stability of our clients’ retirement plans. In the case of Social Security and Medicare, we encourage thoughtful preparation for possible changes to the system while advising against making hasty decisions based on fears that either program will disappear entirely.

In this guide, I describe the current challenges of the Social Security system, illustrate the most likely changes to the program, and outline ways to prepare your retirement plan concerning those changes.

What Is the Current State of Social Security?

Recent projections indicate that Social Security funds will be depleted sometime between 2033-2035 if retirement benefits and payroll deductions remain unchanged.

Over 60 million individuals receive retirement or disability benefits from the Social Security Administration. However, the payroll tax revenue generated by today’s workforce does not fully cover these payments. As a result, the federal trust fund, designed to bridge this gap, is projected to reach a zero balance at some point between 2033 and 2035.

A major reason for this discrepancy is that the Social Security program’s original forecast presumed continued aggressive population growth, which misaligns with today’s birth rates. For instance, Millennials are having fewer children than the Baby Boomer generation did – leading to unexpected shortfalls in the amount of revenue the program is taking in through payroll tax.

What Would Happen if Social Security and Medicare Lost Funding Completely?

Allowing Social Security and Medicare to continue along the same economic path would generate a host of negative consequences for individual citizens, the state of our nation, and America’s global standing. As such, we believe the U.S. government will enact solutions to replenish funding for both programs. Otherwise, the aftermath could be catastrophic:

- Individual consequences

Millions of retirees depend upon Social Security benefits to meet basic needs during retirement. Negatively altering benefits would create food and housing insecurities for many retirees, further emphasizing the inequities between upper and lower-income families. Without Medicare, many older Americans would no longer be able to afford medical treatment or prescription drugs.

- National consequences

Social unrest and heated protests would likely sweep the nation. By eliminating Social Security and Medicare, the U.S. Government would break a long-held promise to American workers that withheld payroll taxes would support them during retirement. Violating this agreement would enrage most citizens while destabilizing the political dynamics of our democracy. - Global consequences

Ending Social Security and Medicare could tarnish the U.S. Government’s international reputation and credit rating. Any sign of financial instability would jeopardize the United State’s status as the financial hub of the global economy and the United States Dollar’s position as the world’s reserve currency.

Will Social Security Go Away During My Lifetime?

We can reasonably assume that Social Security and Medicare will remain intact for retirees and adults already in their 50s or 60s. Younger adults face more uncertainty, but will likely have access to Social Security upon retirement.

- It is politically challenging to cut Social Security retirement benefits.

We expect the government will opt to raise various taxes to create the revenue necessary to prevent the expiration of Social Security and avoid the negative consequences outlined above. - Raising taxes is a more acceptable way to fund the U.S. Government’s expenses.

As we can see in the chart below, the U.S. government’s fixed expenditures have risen at a rapid pace. Given these trends, increasing tax revenues is a more likely and viable political strategy to balance its budget instead of attempting to lower future expenditures by revoking previously promised Social Security benefits.

At Toberman Becker, we believe higher tax revenues may be unavoidable in order to achieve a balanced federal budget in the future.

- Adjusting Social Security benefits would decrease government spending.

Policymakers can modify the Social Security program by balancing the budget in various ways. The U.S. Government might decide to:

- Reduce the amount of monthly retirement benefits.

- Minimize the cost of living adjustment.

- Raise the age of full retirement.

- Remove the inflation adjustment.

At Toberman Becker, we believe that “means testing” is the most likely reduction that could be made – and future risk to high-income families and individuals planning for retirement. In this scenario, policymakers could look at individuals’ income outside of Social Security and determine who has the means to warrant a reduction in benefits.

How Would Higher Income Taxes Affect Personal Finances?

Preserving Social Security will likely require a reduction of retirement benefits or an increase in federal tax rates – including income tax rates. Either change would strain the financial plans of most Americans, but the implications will vary based on individual age and retirement status:

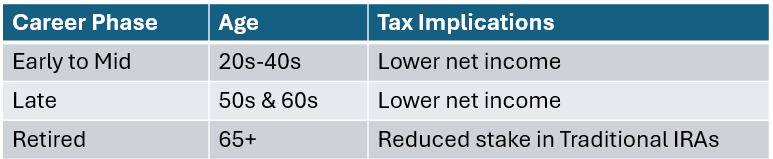

Tax rate increases would impact both working and retired adults. Source: Toberman

With higher payroll deductions and lower net income, working adults may struggle to cover living expenses or find adequate means to save for retirement. For retired adults, higher income tax rates would reduce the realized net value of their pre-tax retirement accounts.

Traditional IRAs are often the largest asset in a retirement portfolio.

Since withdrawals from these accounts are taxable, the U.S. government effectively maintains a form of ownership stake in them. Traditional pre-tax balances are vulnerable because the government can increase its “stake” at any time by changing the tax rate.

In all, the U.S. government holds this stake in over 40 trillion dollars’ worth of traditional retirement funds, and we believe there is a risk that vulnerable, yet-to-be-taxed Traditional IRA dollars could become a key part of the economic plan for increasing tax revenues.

We believe significant pre-tax retirement account balances face a risk of rising income tax rates in the future to help cover the rising public debt and other government obligations.

At Toberman Becker Wealth, we often recommend a Roth conversion strategy to minimize this risk of rising income taxes in the future. Optimizing the drawdown strategy of your retirement plan will also reduce the financial impact if taxes increase.

How to Prepare for the Unknown Future of Social Security

The reliability of a retirement plan increases through strategic analysis and evaluation of known risk factors.

Here are the top 5 strategies to help you prepare for any changes to Social Security:

- Stress test Social Security benefits.

Use retirement models to gain a clearer picture of your financial future. In case the Social Security Administration reduces benefits or alters its payment structure, know how much of your retirement budget depends upon monthly Social Security income. Determine whether your asset mix could maintain your lifestyle with a significantly reduced Social Security benefit. - Evaluate other sources of fixed income.

Social Security benefits are usually only part of a retirement plan’s fixed income sleeve. Calculate all fixed income sources, such as pensions and bond interest, to determine your gross annual income aside from Social Security. Enhance your Treasury investment ladder strategy to increase guaranteed annual cash flow. - Resist the urge to claim Social Security benefits too early.

Retirees who wait until age 70 to claim Social Security will maximize their earning potential and receive 130% of the full Social Security benefit. Delaying Social Security keeps your income low to maximize Roth conversion opportunities while at the same time allowing your future Social Security benefit to grow.

Ultimately, retirement plans are personalized and should reflect a retiree’s appetite for risk. If you are extremely concerned that Social Security will not be there for you as promised, or you have significant health considerations, starting Social Security as soon as possible at age 62 might be the best choice for you individually. - Transfer money out of pre-tax retirement accounts.

Paying tax now via Roth conversion or executing a planned IRA drawdown strategy removes future tax uncertainty. Roth conversions help retirees mitigate risk and save money by paying taxes at a known rate now – or, settling up with Uncle Sam on your terms – instead of at an unknown rate in the future. In addition, IRA drawdowns can provide funds to cover retirement expenses, thus enabling retirees to delay Social Security benefits. - Take advantage of Health Savings Account (HSA) growth potential.

Consider utilizing taxable assets to cover current healthcare expenses. This allows the HSA to grow tax-free like a Roth IRA over the long term for inevitable healthcare expenses later in life.

How Does an Experienced Financial Advisor Help You Prepare?

A financial planner’s responsibility is to ensure clients understand the outcomes of their financial decisions. To achieve this, advisors use advanced software to develop customized financial models that accurately reflect the unique circumstances of a client’s retirement plan.

Retirement models can include individualized forecasts for each possible change to Social Security, including:

- Increased tax rates

- Reduced benefits

- Reduced cost of living and/or inflation adjustments

- Complete dissolution of benefits

At Toberman Becker, we prioritize data-driven decisions, regardless of our perspective. We stress-test many scenarios to avoid surprises and reduce overall risk.

In Conclusion

When preparing retirement forecasts, our base case is that Social Security and Medicare will remain reliable fixtures of the American retirement system as originally promised, but still merit consideration when developing a retirement plan. Active preparation today protects against the unknown circumstances of tomorrow.

Toberman Becker Wealth is a fee-only, independent fiduciary firm based out of St. Louis. Whether starting to dream about retirement in your 50s or actively planning for retirement in your 60s, we help people nearing a transition build a resilient retirement plan. We operate in the best interests of our clients, always, and our top priority is to help you live comfortably now, without sacrificing your financial future later.

If you’re looking for an investment advisor to help you build a diversified retirement plan that ensures comfort and peace of mind, feel free to book a meeting or give us a call.

Continue Exploring Our Retirement Decision Dashboard

Disclosure: Any mention of a particular security and related performance data is not a recommendation to buy or sell. The information provided on this website (including any information that may be accessed through this website) is not directed at any investor or category of investors and is provided solely as general information. Nothing on this website should be considered as personalized financial advice or a solicitation to buy or sell any securities.

Michael is a highly knowledgeable and experienced partner at Toberman Becker Wealth in St. Louis. With his expertise in investment management, behavioral finance, and retirement planning, Michael is dedicated to providing his clients with the best financial guidance possible.

Having worked with clients on complex estate planning and developing investment strategies for a team of advisors, Michael’s experience spans across various areas of financial planning. What truly sets him apart is his unyielding desire to acquire knowledge for the betterment of his clients. At Toberman Becker Wealth, this commitment to continuous learning is the foundation upon which exceptional client experiences are built.

Michael earned a Bachelor of Science degree in Finance and Banking from the University of Missouri – Columbia. Additionally, he holds designations as a Chartered Financial Analyst (CFA) charterholder and Certified Financial Planner (CFP).

Beyond his professional achievements, Michael enjoys a fulfilling personal life in St. Louis. Living with his wife, Lindsey, and their beloved dog, Birk, he finds joy in activities such as golfing together and exploring local restaurants.