A Practical Guide to Bonds & Treasury Investments

Perplexed by his brokerage statement, a client recently turned to me for clarity regarding a Treasury investment in his account. The numbers didn’t quite align, and the financial terminology left him bewildered. I simplified the math and explained the high-level concept through a brief email exchange so he felt more at ease and confident in the bond transaction.

As a seasoned financial advisor, I frequently confront similar hurdles when guiding clients through the complexities of Treasury investments and fixed-income assets in general.

Within this comprehensive guide, I simplify the ‘what’ and ‘why’ of Treasury investments, offering insights and bond portfolio strategies crafted to secure reliable income and provide peace of mind for retirees.

What is a Treasury Investment?

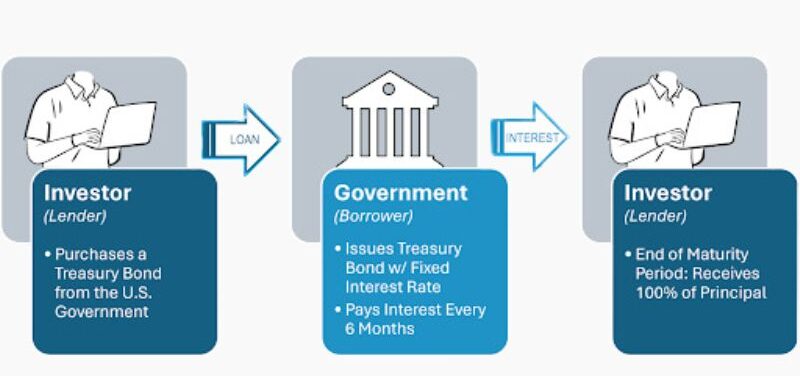

Purchasing a treasury investment is the equivalent of loaning money to the U.S. federal government at a fixed rate of interest, for a pre-designated length of time. Commonly referred to as bonds (or fixed income), these investments accrue interest and deliver coupon rate payouts every 6 months until the bond reaches maturity, at which point the investor receives full reimbursement of the principal value originally invested.

Purchasing a Treasury bond positions the investor as a lender to the United States Treasury Department.

What Are the Different Types of Treasury Securities?

Treasury securities, T-Bills, T-Notes, and T-Bonds, are categorized into three groups according to maturity length and coupon rate payment frequency.

When constructing a portfolio, it can be ideal to have a mix of all three categories. For instance, if immediate liquidity is required, opting for Treasury Bills with shorter maturities is advisable.

Conversely, if the investment horizon is longer, Treasury notes with maturities extending up to 10 years may be more suitable. Generally, longer maturities can often yield higher returns on investment – though not always.

Maturity period term lengths and interest payment schedules for each type of Treasury investment

Are Treasury Bonds Tax-Free?

Although interest earned from Treasury investments is exempt from state and local taxes, it is subject to ordinary federal income tax in the year the income is received. Federal income tax, however, does not apply when Treasury investments are held in a traditional IRA or Roth IRA account. Traditional IRAs do not generate taxable income until funds are ultimately withdrawn from the account, and Roth IRAs are free from income tax in perpetuity.

What’s the Difference Between Stocks and Bonds?

In short, while both are common investment vehicles for investors, bonds generally carry lower risk compared to stocks – and are therefore more common among those nearing the retirement and wealth preservation phase of their journey.

When you buy stock, you acquire ownership in a company and your returns depend primarily on the company’s future economic performance. When you purchase a bond, on the other hand, you loan money to a government entity or corporation and receive guaranteed interest payments along with full repayment of the principal when the bond matures.

What does this mean?

Since stock investments rely on the performance of individual companies, and often the overall state of the economy, they’re considered more risky (in the form of equity risk). In comparison, Treasury investments maintain profitability through maturity as long as the U.S. Government – the strongest entity in the world – remains solvent.

While credit risk is still a factor to consider when investing in fixed income, the key takeaway is that if a company or government goes out of business, bankruptcy regulations dictate that bondholder reimbursement precedes shareholder reimbursement.

Treasury Bonds & Your Retirement Portfolio: What to Know

Investors often utilize Treasury bonds to provide fixed income throughout retirement. Ensuring financial stability across a 30-year retirement requires thoughtful fund diversification and asset-liability matching.

Here are several guiding principles to consider while incorporating a Treasury investment strategy for retirement:

- Provide peace of mind with a 60/40 split – or similar combination suited to your unique willingness and ability to take on risk.

The most common retirement portfolios utilize a split of 60% stocks and 40% bonds. In this case, bonds are generally referred to as fixed income. Fixed income generated by bond interest and maturity payouts guarantees a predictable level of liquidity throughout retirement, regardless of the stock market’s ups and downs.

Our approach: We aim to allocate 6-8 years of living expenses in the fixed income sleeve. This ensures that clients have adequate funding to sustain their retirement lifestyle without the need to sell shares at a loss during periods of stock market downturns.

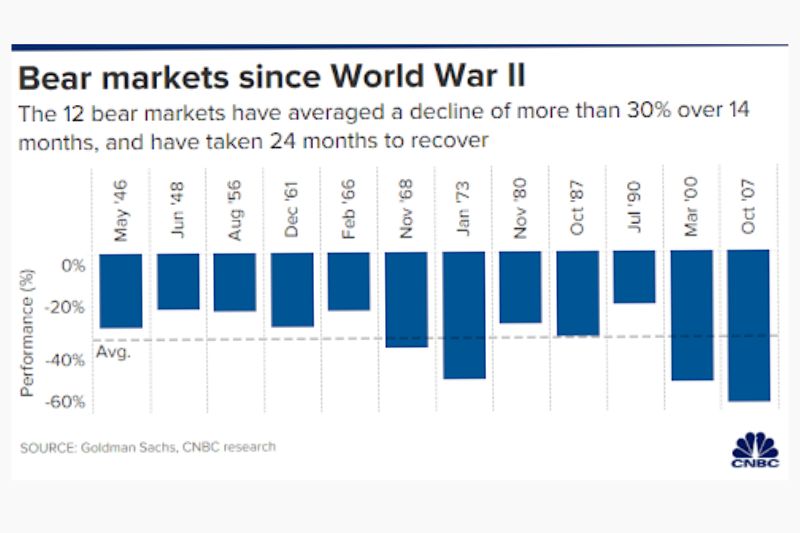

On average, bear markets bounce back within 2 years, but we cushion that statistic significantly to grant our clients the psychological peace of mind that they are very likely to be okay no matter what goes on in the world beyond their control.

Source: Goldman Sachs, CNBC.

- Minimize risk with a laddered approach.

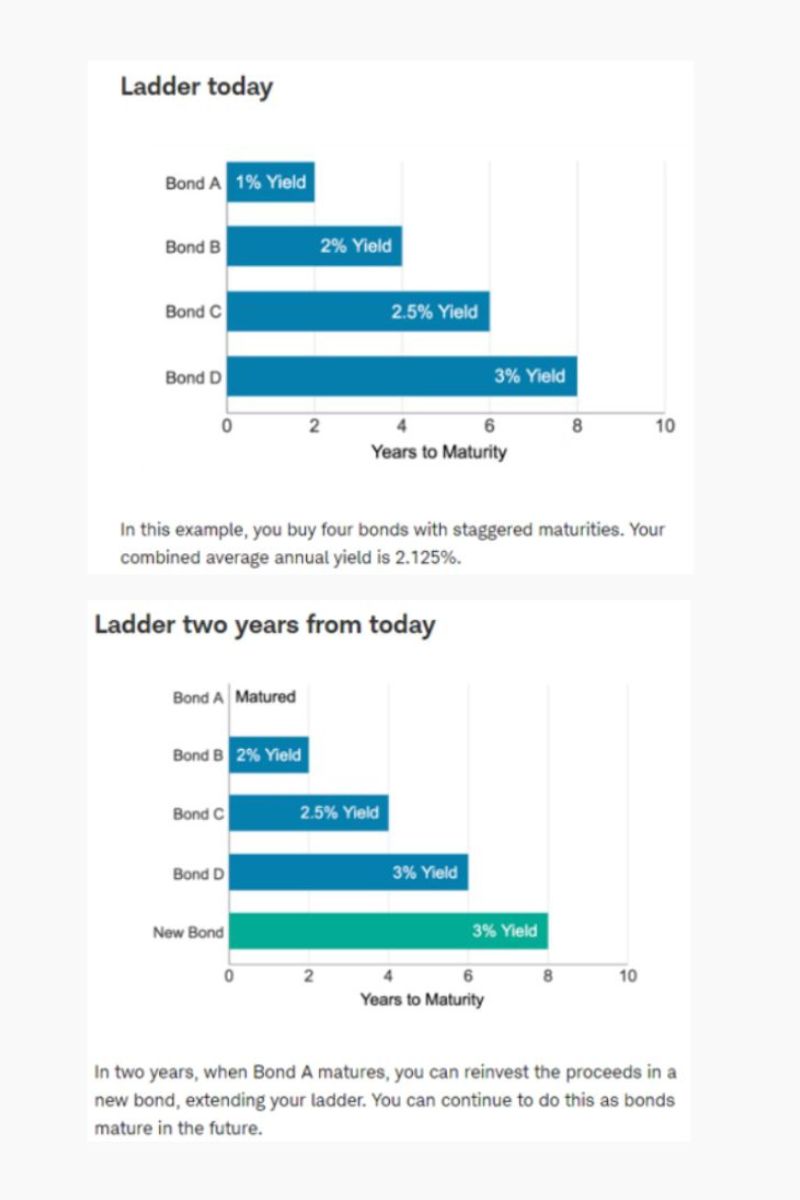

Diversify a bond portfolio across various maturity dates to diminish the interest rate risk. A laddered approach staggers maturity dates such that a retiree receives principal reimbursements on a set schedule to cover their retirement lifestyle without worrying about the state of interest rates or the stock market in any given year.

Our approach: We design Treasury bond ladders in approximately 8-year increments to safeguard clients against economic risk factors and often curate the schedule such that the client receives bond maturity payouts every January. That way each year begins with a sizable cash payment that clients can:

- Use throughout the year (if needed).

- Reinvest at current interest rates.

- Rebalance into the stock portion of their nest egg.

For instance, a client in St. Louis can often retire comfortably with a 1 million dollar portfolio. As a simple illustration – following the 60/40 rule, $400,000 of the portfolio is placed into a fixed-income bond ladder and distributed at a cadence of $50,000/year for 8 years. When you factor in Social Security benefits, those two buckets of fixed income alone can provide a suitable lifestyle.

A bond ladder distributes fixed income across staggered maturity dates.

Source: Schwab.com

- Analyze inflation trends while developing a T-bond ladder.

Since a bond’s interest rate is fixed for the entirety of its term, bonds with lengthy maturity periods are more vulnerable to the threat of inflation. Short-term bond positions perform more favorably in rising-rate environments, whereas long-term bond positions thrive in falling-rate environments.

If you buy a 20-year bond at a time when interest rates are low, and later on, inflation and interest rates rise, the value of your money diminishes compared to what it could buy originally. Upon maturity, the real value of the principal reimbursement (after factoring in realized inflation) falls short of your original target.

Our approach: When creating a T-bond ladder for a client’s fixed-income portfolio, we keep a close eye on the overall average maturity of the holdings. Diversification is key, and in periods of expected rising inflation, we prefer shorter-term strategies that allow for mitigation of inflationary risk across the yield curve.

Short-term bonds enable clients to more quickly redeploy investments at higher interest rates over time when rates spike. Although long-term bonds offer less flexibility, they perform better in periods of falling interest rates.

- Focus on yield-to-maturity calculations.

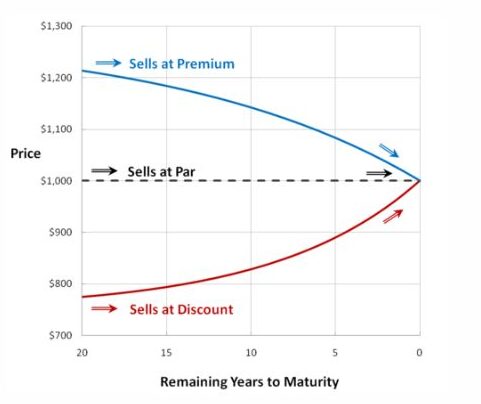

Yield to maturity (YTM) is the number one metric to monitor when entering into an individual bond position. YTM reflects the total interest rate earned when an investor buys the bond at market price and holds it until maturity.

Bonds can be purchased immediately upon issue, or at any point during its term through a secondary market. The prevailing interest rate at the time of a post-issue acquisition influences the bond price and the YTM received by the investor. Usually, as interest rates decline, bond prices increase, and conversely, when rates rise, bond prices tend to decrease.

Our approach: For our clients, we carefully analyze the YTM to determine an individual bond’s true expected performance. An appealing coupon rate is not enough to validate a secondary market bond purchase. We need to also factor in the difference between the price we pay for the investment and the full principal or par amount we expect to receive back at maturity.

For instance, let’s say a 10-year $1,000 bond gets issued with a 4% fixed interest rate in Year X. Two years later, in Year Z, interest rates have dropped to 3%. The bond will now be available on the secondary market for a premium because the 4% coupon rate outdelivers bonds issued in Year Z. Calculating the YTM dictates whether the higher coupon rate justifies the higher premium.

Bond prices at par, premium, and discount rates.

Source: Fincash

- Too much of a good thing can spoil a portfolio.

Allocating a majority share of assets into Treasury investments can expose certain retirees to a dangerous level of inflation risk. During periods of inflation, investors can lose real wealth and purchasing power if their fixed income sleeve is too heavily weighted – and especially if its maturities or duration are too long on average.

While there are no regulatory limits on how many Treasury investments a retiree can purchase, over-utilizing fixed income can jeopardize the real value and growth potential of a long-term retirement portfolio.

Our approach: We partner with clients to design bucketing strategies that preserve short-term funds in bonds and allocate long-term money into the diversified stock market. Stocks generally pose a lower inflationary risk because companies can adapt to economic conditions and pass through rising costs to their customers.

- Consider three options when a bond reaches maturity.

Once a bond matures and the U.S. Treasury returns the principal, an investor can choose between three main courses of action:

- Transfer the funds into a high-interest cash account for short-term spending.

- Invest in the stock market to rebalance their target portfolio ratio (e.g., 60/40) – especially if stocks have dipped during the bond’s term.

- Redeploy funds somewhere along the bond ladder –especially if rates have climbed during the bond’s term.

Treasury Bond FAQs

Q: Are T-bonds a safe investment?

A: Treasury bonds provide as much safety as any other interest-bearing asset in the world. Finance professionals often refer to them as “risk-free” because the credit risk – the risk of the U.S. Government itself becoming insolvent – is so minute.

Q: Are T-bonds FDIC insured?

A: FDIC insurance extends the backing of the U.S. Government to bank products, so this type of coverage does not apply to T-bonds as they are a product of the U.S. Treasury and; therefore, are already fully backed by the faith and credit of the U.S. Government.

Q: When would I opt for a municipal bond over a Treasury bond?

A: Despite the lower interest rates of municipal bonds, individuals in the highest income tax brackets can sometimes benefit from a municipal bond investment strategy because interest earnings from municipal bonds are not federally taxed. To assess the trade-off, high-earning investors should calculate the ‘tax-equivalent yield’ of a municipal bond and compare it to a treasury investment of similar maturity.

Q: Are T-bonds better than Certificates of Deposit (CDs)?

A: Unlike CDs, which are capped at $250,000 per institution to preserve FDIC insurance, Treasury investments are fully backed by the government without limitation. Additionally, investors can typically liquidate a T-bond at any point, for any reason, without the restrictions of surrender charges and lockup periods that impact many CD holders. Additionally, interest earned from CDs typically incurs state income tax, whereas interest earned on Treasury investments does not.

Q: Should I purchase a bond fund instead of individual bonds?

A: Individual bonds are preferable to bond funds when building a Treasury investment ladder. We typically avoid bond funds when building out the fixed income sleeve of a client’s retirement portfolio because they generally lack a fixed maturity date and that interferes with the successful deployment of a laddering strategy.

Q: Do I need a financial advisor to purchase Treasury bonds?

A: Partnering with a financial advisor can help you optimize asset-liability matching across the yield curve and customize a ladder strategy based on your personal retirement goals, but you can also self-manage a bond portfolio through a brokerage platform like Charles Schwab.

In Conclusion

As long as the U.S. Government stays in business, fixed-income investments are a low-stress way to reliably support your retirement goals without worrying about news headlines or stock market reports.

A well-crafted Treasury investment strategy acts as the umbrella in your car on a sunny day. You’ll be glad it’s there if the clouds turn gray and thunder rocks the sky.

Toberman Becker Wealth is a fee-only, independent fiduciary firm based in St. Louis. Whether starting to invest for retirement in your 50s or actively planning for retirement in your 60s, we help people nearing a transition build a resilient retirement plan. We operate in the best interests of our clients, always, and our top priority is to help you live comfortably now, without sacrificing your financial future later.

If you’re looking for an investment advisor to help you build a diversified strategy that hedges against risk, feel free to book a meeting or give us a call.

Disclosure: Any mention of a particular security and related performance data is not a recommendation to buy or sell. The information provided on this website (including any information that may be accessed through this website) is not directed at any investor or category of investors and is provided solely as general information. Nothing on this website should be considered as personalized financial advice or a solicitation to buy or sell any securities.

Craig Toberman is a Partner at Toberman Becker Wealth – a fee-only, fiduciary financial advisor based in St. Louis. He assists families and businesses with strategic financial planning and long-term wealth management. He has over a decade of experience in financial services and has crafted custom financial plans for hundreds of families and businesses.