Does Diversification Eliminate Risk? What Investors Need to Know

Market volatility can be unsettling, especially when you see your portfolio dip alongside the swigs. One of the most effective ways to manage that uncertainty and stay committed to your long-term strategy is through proper diversification.

In this article, I share what you need to know about diversification: how it’s defined, why it matters, and how to achieve it to maximize your portfolio returns.

What Is Diversification and Why Is It Important?

Does Portfolio Diversification Eliminate Risk?

How to Measure Your Portfolio Diversification

How to Diversify Your Portfolio

What Is Diversification and Why Is It Important?

Diversification is one of the most important steps you can take to help ensure your portfolio enjoys a smooth and steady ride throughout retirement.

At its core, diversification means balancing your investments across a range of assets. By spreading your money out, your portfolio is better positioned to handle different market conditions and economic cycles.

In practice, diversification can help:

- Reduce big swings in performance

- Improve long-term predictability

- Strengthen retirement planning outcomes

How Can Diversification Help Lower Investment Portfolio Risk?

Diversification helps lower your investment portfolio risk, but it will never eliminate it.

Risk is an inevitable part of investing. If you want to maximize your portfolio growth and keep up with long-term inflation, there’s no way around it.

The end goals of diversification are to:

- Help you achieve long-term financial goals with less volatility

- Reduce extreme fluctuations in portfolio value

- Improve returns per unit of risk taken

- Avoid overconcentration in a single company or sector

- Minimize the impact of one adverse event derailing your entire portfolio

Where to begin:

Start by evaluating your current diversification, clarifying your long-term goals, and determining the amount of risk you’re willing and able to take. From there, you can align your portfolio with your risk profile and your objectives.

Toberman Becker Wealth Helps Align Your Portfolio With Your Risk Tolerance

How to Measure Your Portfolio Diversification

Understanding your diversification is more than entering your investments into a portfolio diversification calculator. There’s no universally accepted “diversification score,” because the right mix depends on your goals, time horizon, and risk tolerance. A helpful starting point is reviewing your:-

Asset Allocation

The balance between U.S. and international investments, stocks and bonds, and various market sectors. -

Correlations

Whether your investments tend to move together, highly correlated assets increase risk. -

Concentration Risk

Looking at how much of your portfolio is tied to a single sector, company type, or geographic region. -

Volatility

How frequently and sharply your investments fluctuate.

Note: Volatility isn’t inherently bad—but it must match up with your risk tolerance.

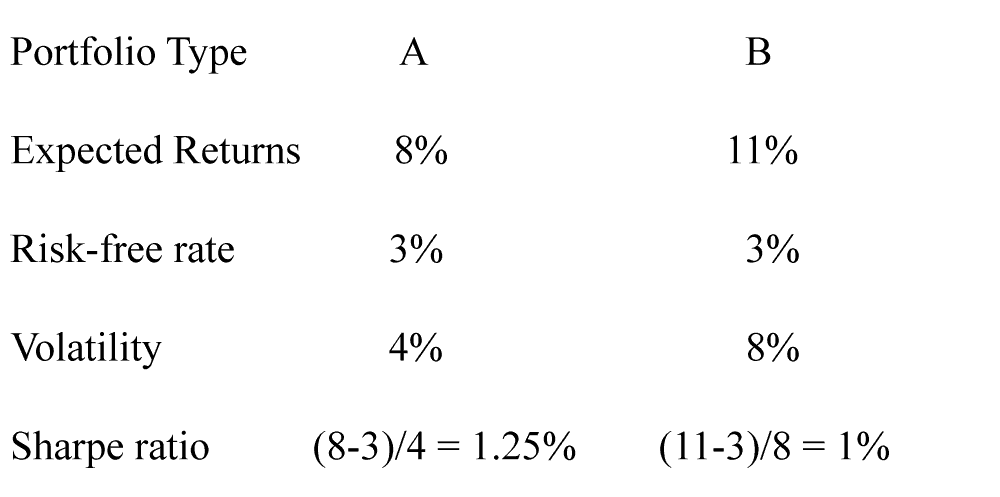

The Sharpe Ratio: A Valuable Tool for Measuring Your Risk Alignment

The Sharpe Ratio helps investors understand the relationship between the risk they’re taking and the returns they’re earning. Think of it as a report card that shows whether your current investments are providing enough reward for the level of risk in your portfolio. Example: If Portfolio A and Portfolio B have similar returns but Portfolio A has a higher Sharpe Ratio, Portfolio A delivers better risk-adjusted performance.

How to Diversify Your Portfolio

Modern Portfolio Theory (MPT), developed by economist Harry Markowitz, provides a data-driven framework for building a well-diversified portfolio. The idea is simple: seek investments that give you the best possible return for the level of risk you’re willing to take—and stick with that risk level through market ups and downs.

A chart demonstrating Modern Portfolio Theory.

Source: Forbes Advisor

Steps to Reach the Efficient Frontier (According to MPT)

- Seek investments that don’t all move the same way (look for low correlation).

- Build a long-term, disciplined asset mix.

- Monitor your portfolio periodically, but avoid reacting to every market swing.

What Is Noncorrelation—and Why It Matters

Noncorrelation means investing in assets that aren’t closely connected. When your investments aren’t tied to the same factors, your portfolio is less likely to rise and fall all at once.

Microsoft and Apple are highly correlated; they’re both major U.S. tech companies competing in the same space. If one drops due to a tech-sector slump, the other is likely to follow.

To reduce correlation, pair a U.S. tech stock with, say, a European manufacturing company. Because they operate in different industries and regions, they’re less likely to react the same way during market volatility.

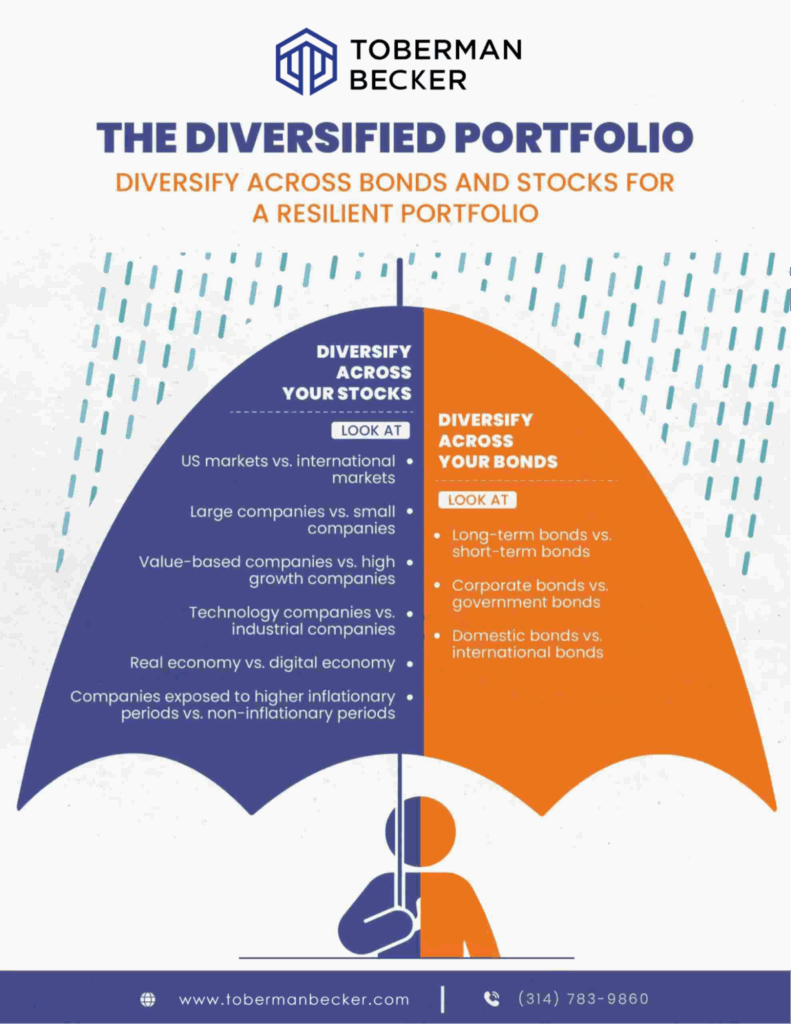

By spreading your investments across different asset types—like stocks, bonds, sectors, and regions—you create a portfolio that performs more steadily through changing market conditions.

- U.S. vs. international

- Large-cap vs. small-cap

- Value vs. growth

- Technology vs. industrial

- Real assets vs. digital assets

- Inflation-sensitive vs. disinflationary companies

- Long-term vs. short-term

- Corporate vs. government

A chart demonstrating portfolio diversification.

Source: Fidelity

How a Financial Advisor Helps Diversify Your Portfolio

A financial advisor helps you maximize the return on your retirement savings per unit of risk assumed, aiming to secure a successful retirement while taking no more risk than necessary.

Diversification is central to achieving this balance.

At Toberman Becker Wealth, we apply advanced models such as Monte Carlo Simulations to forecast your future retirement cash flows and test a wide range of “what-if” scenarios. These simulations help us visualize how your plan might perform in various scenarios.

By taking a comprehensive and data-driven look, we’re able to design a diversified portfolio that:

- Works efficiently for your goals

- Reduces the likelihood of significant negative outcomes

- Provides confidence and clarity through changing markets

Toberman Becker Wealth will help you build the retirement you’ve dreamed of.

From tax-efficient withdrawal strategies to long-term legacy building, we’re here every step of the way.Financial Advisors Support You Long-Term

Building a portfolio is far from a one-time event. When your circumstances or goals change, you must adjust your portfolio to align with your risk tolerance and retirement objectives.

At Toberman Becker Wealth, we don’t “set it and forget it” or use a robotic algorithm to predict the future. We use our experience to continually:

- Analyze new data

- Reevaluate goals

- Adjust your portfolio when needed

- Keep your long-term strategy intact

Our Process is Simple:

- Introductory Meeting

We get to know you, your circumstances, and your future plans. We ask questions, make projections, and help you start defining your financial goals. We use all of these to form a long-term financial plan, taking into account a high-level diversification that best fits your objectives for the next 30 years. - Establish Risk Tolerance

Next, we stress-test your goals to assess the amount of risk you’re willing to take on and bear. This allows us to determine the investment return required without taking on unnecessary risk. - Create a Plan and Build the Portfolio

Based on steps one and two, we begin constructing a portfolio that represents you, your goals, and your risk tolerance, and that hedges against risk to the extent practicable. Our objective is to create a steady rate of returns while minimizing volatility. - Monitor and Adjust as Necessary

While a portfolio should be developed for long-term success without microadjusting to market fluctuations, it should also be regularly reviewed to ensure investments remain aligned with long-term goals. We realign with new goals or life changes without causing unnecessary disruption.

When life changes, whether that be a job transition, an evolving risk appetite, or nearing retirement, we return to step one and adjust your portfolio to meet your long-term goals.

Diversification Can Help Lower Investment Portfolio Risk — and We Can Help

Diversification doesn’t eliminate risk, but it does help you manage volatility so you can stay focused on your long-term financial goals. By building a well-balanced portfolio and revisiting it regularly, you give yourself the best chance to weather market swings and achieve more stable, consistent returns over time.

Toberman Becker Wealth is a fee-only, independent fiduciary based in St. Louis. Whether starting to invest for retirement in your 50s or actively planning for retirement in your 60s, we help people nearing a transition build a resilient retirement plan. We always operate in our clients’ best interests, and our top priority is to help you live comfortably now without sacrificing your financial future later.

If you ever have a question about your retirement planning strategy, feel free to book a meeting or give us a call.

Portfolio Diversification FAQs

Michael is a highly knowledgeable and experienced partner at Toberman Becker Wealth in St. Louis. With his expertise in investment management, behavioral finance, and retirement planning, Michael is dedicated to providing his clients with the best financial guidance possible.

Having worked with clients on complex estate planning and developing investment strategies for a team of advisors, Michael’s experience spans across various areas of financial planning. What truly sets him apart is his unyielding desire to acquire knowledge for the betterment of his clients. At Toberman Becker Wealth, this commitment to continuous learning is the foundation upon which exceptional client experiences are built.

Michael earned a Bachelor of Science degree in Finance and Banking from the University of Missouri – Columbia. Additionally, he holds designations as a Chartered Financial Analyst (CFA) charterholder and Certified Financial Planner (CFP).

Beyond his professional achievements, Michael enjoys a fulfilling personal life in St. Louis. Living with his wife, Lindsey, and their beloved dog, Birk, he finds joy in activities such as golfing together and exploring local restaurants.