When Is The Best Age To Retire?

Throughout my time as a fee-only financial advisor, I’ve found that there is always a subset of clients hinting at the idea of retiring earlier than 65. Whether they’re 100% committed or not, retirement is not a topic that should be taken lightly. In fact, potentially quitting your life’s work forever is one of the most important and influential decisions you may ever make.

In this article, I’ll discuss the pros and cons of retiring early, and then share how you can factor in the ‘4% Rule’ (of thumb) to see if you’re financially ready to take that leap into retirement.

What are the pros and cons of taking an early retirement?

As a practicing retirement planner, I’m constantly talking to clients about their desire to retire and when they can feel confident in transitioning into their golden years. I’ve compiled a comprehensive list of how my clients tend to reason through the ongoing decision of when’s the best age to retire.

Pros and Cons of Retiring Early

| Pros | Cons | |||

|---|---|---|---|---|

| Time, freedom, and autonomy that comes from exercising financial independence. | Possible loss of a sense of purpose, fulfillment, and structure that comes from decades of consistent employment. | |||

| Improved health and wellbeing (i.e., more time available to focus on taking care of yourself). | Loss of employer benefits and the ability to continue adding savings to your retirement nest egg. | |||

| More time for family and friends. | Increased health insurance costs if retiring before Medicare eligibility at age 65. | |||

| More time for travel. | Potentially smaller Social Security benefits in the future. | |||

| More time to pursue hobbies and interests. | Increased exposure to financial uncertainty due to a longer time retirement time horizon (i.e., more time in which something could go wrong). | |||

| An opportunity to start a new career or passion project. | Potential for longevity risk. |

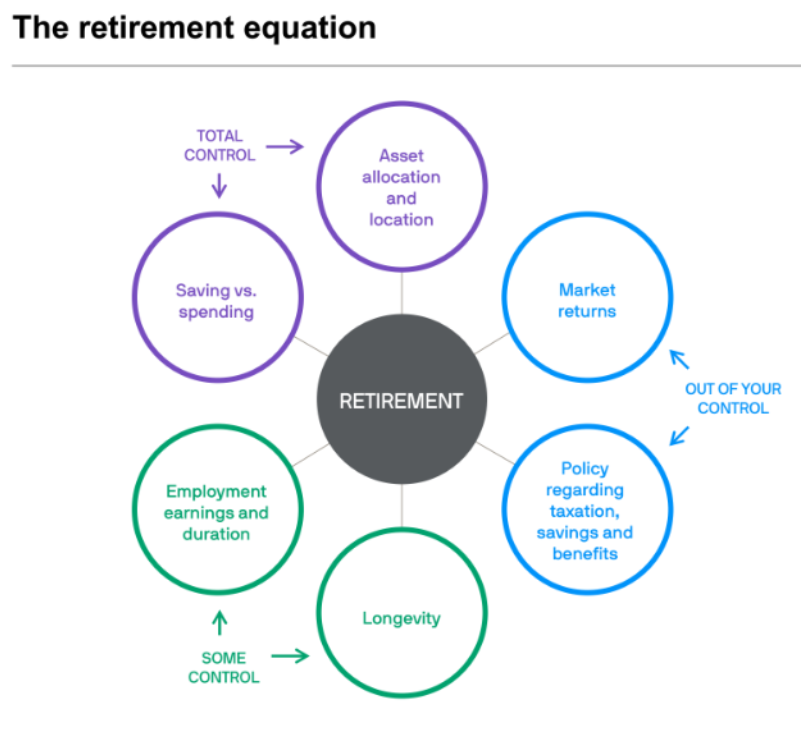

What are the most important factors that play into my decision?

Determining the goals and lifestyle you (and your spouse, if applicable) want to enjoy throughout your retirement years is the first and most important step in the retirement planning process. Before establishing an investment portfolio, it’s essential to take an introspective look, ask the hard questions, and hold honest conversations about what you expect your golden years to look like. Only once that foundation is built can you start creating a personalized investment portfolio that realistically aligns with your needs and long-term goals.

Time and money are two major resources that I encourage all of my clients to consider when determining their retirement plans.

1. Time

Time is a finite resource – you don’t get it back and you can’t make more of it. It’s so important to guard your time with great care and never take it for granted. Too many people make the mistake of working longer than they need to and then, as soon as they get the freedom to live their dreams, they lack the stamina or the physical health to see them through.

If your retirement picture looks good and your finances can support the lifestyle you’re looking to achieve in retirement, then any extra year of work just becomes a year of foregone life experiences that you’ll never get back. So, if there’s a high probability that you’re going to be able to meet all of your goals without ever having to stress out about running out of money, then that extra year of work will only sacrifice the time you have living out your life’s passions whether it be spending time with family, traveling, or pursuing your hobbies.

2. Money

Money on the other hand, is infinite – you can always make more or – if necessary – you can adjust your lifestyle to live within your means. Ideally, however, you want to ensure that the lifestyle you’re accustomed to can be maintained in retirement. In order to do this, you have to stress test your assets against your financial goals to determine your financial readiness.

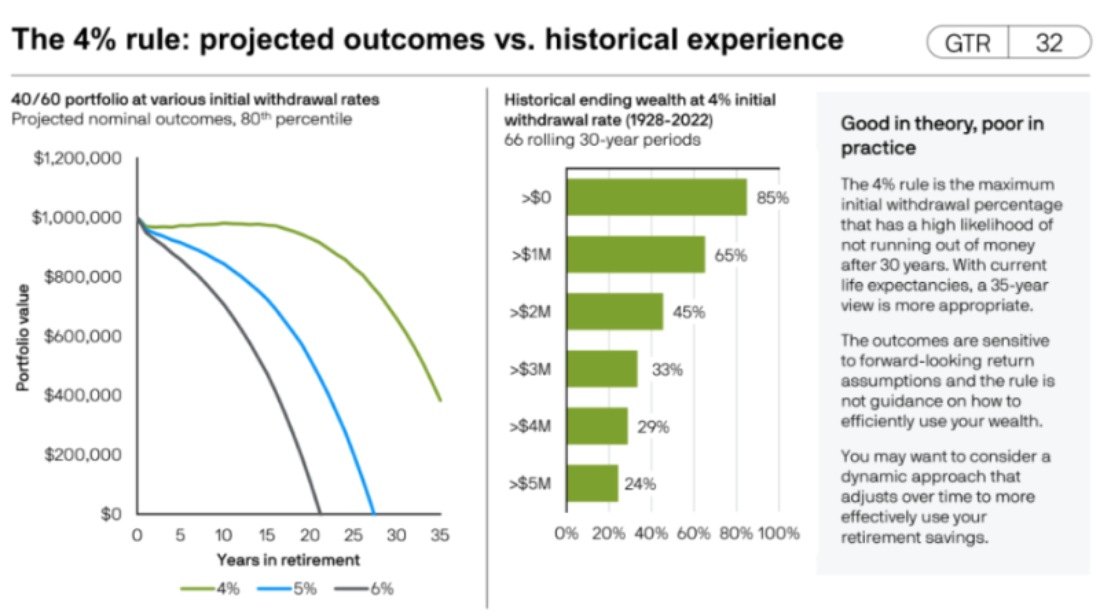

Though this seems complex, it doesn’t have to be. In fact, whenever a client starts thinking about retirement, we first apply the 4% Rule to give a general overview of their portfolio and the ability it has to cover your needs for the rest of your life.

What is the 4% Rule?

The 4% Rule is a practical rule of thumb that retirees can use to determine how much they should withdraw from their retirement funds each year. It claims that you should be able to live the remainder of your life on a predetermined income while factoring in inflation and investment growth –all with a relatively low likelihood of ever having to worry about tightening your belt due to unforeseen circumstances. The ultimate goal is to establish a steady income stream that has a reasonable probability of meeting all the current and future financial needs of the retiree.

Steps to take when applying the 4% Rule to your portfolio

1. Determine how much you are spending now.

What are you accustomed to spending each year and how much do you actually need to live comfortably?

2. Consider your debt that will (and will not) be dropping off soon.

- Do you have any credit card debt?

- Are you close to paying off your mortgage, car payments, and other loans?

- Are your kids going away to college, graduating, or financially independent?

3. Decide how much income you’ll need annually to live.

- What do you foresee your cost of living to be?

4. Take that annual spending and multiply it by 25.

For example, if you think you’ll need $60,000 of income per year from your investment portfolio (above and beyond your Social Security retirement benefit), you can multiply that by 25 to see that you’ll need a nest egg of about $1.5 million before you can put in your 2 weeks notice with your boss.

The rule of thumb considers: How much do I need to have saved up in my 401k and other savings before I can retire with confidence? And the answer should be: Enough to where 4% of that number, plus your Social Security benefit, will make you happy and live comfortably.

Note: 25 is the inverse of the 4% Rule. That is, 1 ÷ .04 = 25.

5. Determine your retirement path.

After we complete these 4 steps, we’re able to draw a clear picture for a relatively straightforward assumption. The math delivers the facts of whether you’re able to retire next year or if you’re going to have to work for longer than you had hoped. Either way, the 4% Rule can pretty quickly navigate your retirement plans – good or bad. After this stage, we can dive deeper in building out your custom retirement model to prove its effectiveness under your specific circumstances.

Adjusting your spending estimate is possible… and you may still be able to retire sooner than you thought.

Even if your portfolio can’t satisfy the estimate you first assumed, it doesn’t mean you have to sacrifice more time to make more money. In fact, the good news is that the $60,000 spending figure used above is entirely within your control, and you can proactively contain it based on the standard of living you choose to pursue throughout your golden years.

There are plenty of ways to live a happy life with less. In my article, Is St. Louis a Good Place to Retire, we highlight a variety of factors that make an area “retirement friendly”. Outside of quality healthcare and lower taxes, many people fail to consider important variables such as cost of living, weather, seasonality, and recreation.

In conclusion

Though many desire to live in the moment, it is crucial that you prepare for a secure future. The decision to retire should not be made in haste, and maintaining balance between your current self and future self should always be considered. You must weigh the potential pros and cons against your financial situation and preparedness before making the ultimate decision to retire.

It’s not always a mathematical formula, spreadsheet, stress test, or list of rules that will guarantee a secure future (though, these things are an important first step). The truth is, there are many intangible and emotional variables that also need to be considered. Thorough financial planning, including creating a retirement budget and consulting with a financial advisor, can help mitigate some of these challenges and ensure a more secure retirement.

At Toberman Becker Wealth, we are a fee-only, independent fiduciary firm that operates within the best interests of our clients, always. Whether you’re retirement planning in your 50s or retirement planning in your 60s, it’s never too late to start exploring your retirement options. If there’s ever a question you have about your retirement planning preparedness, feel free to book a meeting or give us a call.

Disclosure: Any mention of a particular security and related performance data is not a recommendation to buy or sell. The information provided on this website (including any information that may be accessed through this website) is not directed at any investor or category of investors and is provided solely as general information. Nothing on this website should be considered as personalized financial advice or a solicitation to buy or sell any securities.

Craig Toberman is a Partner at Toberman Becker Wealth – a fee-only, fiduciary financial advisor based in St. Louis. He assists families and businesses with strategic financial planning and long-term wealth management. He has over a decade of experience in financial services and has crafted custom financial plans for hundreds of families and businesses.