What to Know About St. Louis, MO Bonds & the Latest Rating Upgrade

St. Louis is making headlines with a recent increase in its municipal bond rating, a snapshot of the city’s financial strength and balanced budget. In July of 2024, Fitch Ratings awarded a boost to the St. Louis credit rating due to the city’s financial stability. While the increase might seem minor, this change marks another step towards growth and revitalization for our beloved Gateway City.

This article will explore municipal bonds, why they matter to investors, and how this upgrade reflects the city’s potential. More importantly, we’ll look at what this means for the future of St. Louis—a city with a rich history now poised for an even brighter future.

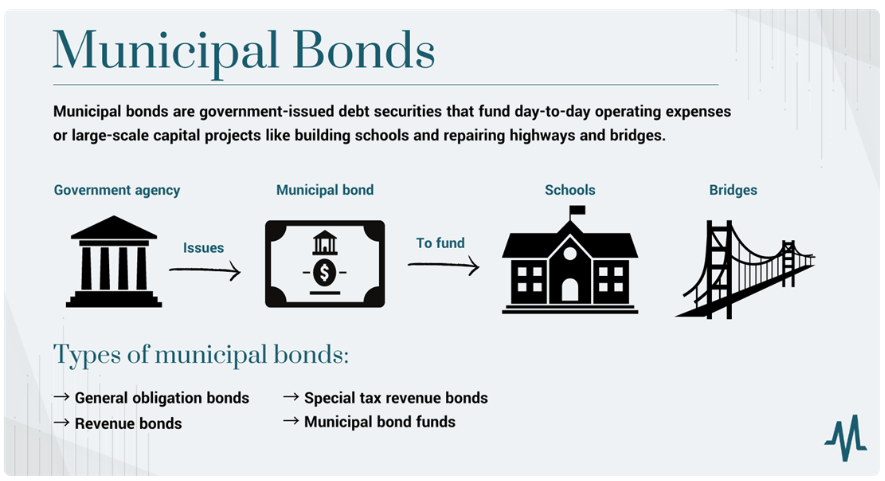

What are Municipal Bonds?

Municipal bonds, also known as “munis,” are issued by local, state, or city municipalities to raise money for public projects and day-to-day expenses.

Source: MarketBeat

These bonds are unique for a few reasons:

- Tax Benefits:

Municipal bonds enjoy favorable tax treatment, particularly beneficial for wealthy/high-income investors. They are exempt from federal income taxes and may also be exempt from state and local taxes.

- Low Risk:

Municipal bonds are considered low-risk investments because issuers are generally reliable in repaying their debts. However, some may still fail to pay interest or repay the principal.

- Diversification:

Investing in municipal bonds can help smooth out the volatility and risk of a stock portfolio.

- Invest in Your Community:

These bonds help finance public projects and infrastructure, such as schools, contributing to improving your community.

What are the Ratings, and How Are They Updated for Municipal Bonds?

Independent rating agencies, such as Lacie, Moody’s Standard, S&P Global, and Fitch Ratings, assign credit quality ratings to municipal bonds.

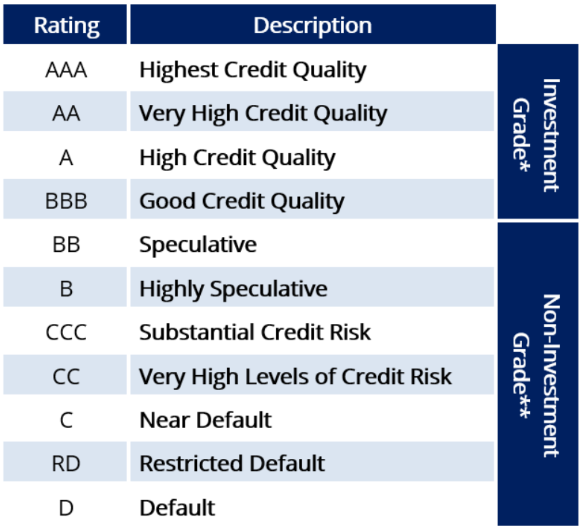

Fitch, for example, uses a letter-based system; these ratings determine whether bonds are considered investment-grade or non-investment-grade. In the recent upgrade of the St. Louis municipal bonds, Fitch Ratings assessed the city’s financial health, considering factors such as the type of debt it holds, its sensitivity to interest rates, and other economic changes.

*Investment-grade category ratings that reflect a relatively low risk of default. **Non-investment grade category ratings that are speculative.

It should be noted that +/- modifiers are used for each category between AA and CCC (e.g., AA+, AA, AA-, A+, A, A-, BBB+, BBB, BBB-, BB+, BB, BB-, B+, B, B-, CCC+, CCC, CCC-).

Source: Corporate Finance Institute

Key Factors Behind St. Louis, MO Bond Rating Upgrade?

In July 2024, Fitch Ratings upgraded the City of St. Louis, MO’s Issuer Default Rating (IDR) to “AA” from “A” and leasehold revenue bonds to “AA-” following the implementation of Fitch’s new U.S. Public Finance Local Government Rating Criteria.

Summary of Factors Leading to the 1-Tier Upgrade:

- Financial Resilience

St. Louis holds a strong financial resilience rating (‘aaa’), with 52% of spending reserves– well above the 15% required minimum. This solid reserve position supports a positive outlook.

- Demographic Challenges

While the city faces a declining population and lower median household income, its large universities contribute to a well-educated workforce.

- Economic Role

St. Louis contributes about 0.9% of the U.S. GDP, a key role in the regional economy. However, the long-term population decline limits growth potential.

- Liability & Debt

St. Louis’s debt burden is moderate, with high costs relative to personal income. However, these are manageable when compared to the city’s total revenue.

- Bond Ratings

Leasehold revenue bonds are rated lower than the city’s Issues Default Rating (IDR) due to a higher risk, as they rely on discretionary annual funding.

Impact of Criteria Change

The upgrade is primarily due to Fitch’s revised rating criteria, emphasizing reserve levels relative to debt. The shift from “A” to “AA” reflects this internal change, signaling a slightly improved outlook for St. Louis’ financial future.

How Does a Bond Rating Upgrade Impact St. Louis and Its Residents?

The recent rating upgrade can significantly ease the city’s ability to raise funds for future projects. While the upgrade may seem minimal and specific to one of the three major agencies, it generally indicates a stronger credit quality. Higher ratings often lead to greater access to financing and lower yields and interest rates on obligations, benefiting a city as an issuer.

It’s important to clarify that when news headlines announce Missouri’s rating upgrade, they refer specifically to the IDR, which assesses the city’s capacity to meet its current obligations. This rating could change if additional debt is incurred, as it primarily reflects the city’s financial situation and outstanding bonds.

The strong IDR signifies a high likelihood of full repayment for St. Louis municipal bonds currently available in the secondary market. In the second-highest tier, this rating is attributed mainly to the city’s robust reserves relative to its debt burden and annual interest costs.

What Does a Higher Bond Rating Mean for Investors?

For an investor, a higher bond rating provides a lower risk (or greater certainty) of receiving your principal back at the end of the bond term. However, this also typically results in a slightly lower yield over the bond’s life. This is because you are investing in a more creditworthy municipality, while a less creditworthy issuer would need to offer a higher interest rate to attract investors.

How Can Bond Ratings Influence St. Louis Developments?

A higher bond rating leads to lower interest rates on new loans, enhancing the potential for development expansion. St. Louis’s ongoing improvements in its financial reserves and ability to meet current liabilities make the city more attractive to investors, increasing the likelihood of securing financing for future projects. As these projects vary in scale and duration, a broader investment base may become interested in holding municipal bonds issued by the city.

These developments could drive continued growth in St. Louis, making it a more appealing destination for new residents and retirees. Many community members are eager to see this progress, especially with the recent resurgence in downtown St. Louis, partly fueled by the arrival of the St. Louis City MLS soccer team, for example. As St. Louis continues to build on its strengths, including its robust educational institutions and healthcare sector, the growth potential becomes even more promising. As more businesses and jobs return to St. Louis, they will generate additional tax revenue, further strengthening the case for increased investment in the city.

In Conclusion

The recent upgrade of St. Louis’s bond rating marks a promising moment in the city’s financial journey, highlighting its commitment to fiscal responsibility and sustainable growth. This upgrade in credit rating signifies improved economic health, boosting investor confidence and paving the way for increased funding.

At Toberman Becker Wealth, we empower our clients to seize these promising investment opportunities, strategically aligning their portfolios with the city’s economic growth to help secure a comfortable retirement.

While municipal bonds might not be the most enticing investment for most investors, their upgrades can create ripple effects that enhance the appeal of local investment avenues. Together, we can navigate this evolving landscape, ensuring our clients are well-positioned to benefit from St. Louis’s bright future.

Toberman Becker Wealth is a fee-only, independent fiduciary firm based in St. Louis. Whether you start dreaming about retirement in your 50s or actively planning for retirement in your 60s, we help people nearing a transition build a resilient retirement plan. We always operate in the best interests of our clients, and our top priority is to help you live comfortably now without sacrificing your financial future later.

If you’re looking for an investment advisor to help you build a diversified retirement plan that ensures comfort and peace of mind, feel free to book a meeting or give us a call.

Disclosure: Any mention of a particular security and related performance data is not a recommendation to buy or sell. The information provided on this website (including any information that may be accessed through this website) is not directed at any investor or category of investors and is provided solely as general information. Nothing on this website should be considered as personalized financial advice or a solicitation to buy or sell any securities.D

Michael is a highly knowledgeable and experienced partner at Toberman Becker Wealth in St. Louis. With his expertise in investment management, behavioral finance, and retirement planning, Michael is dedicated to providing his clients with the best financial guidance possible.

Having worked with clients on complex estate planning and developing investment strategies for a team of advisors, Michael’s experience spans across various areas of financial planning. What truly sets him apart is his unyielding desire to acquire knowledge for the betterment of his clients. At Toberman Becker Wealth, this commitment to continuous learning is the foundation upon which exceptional client experiences are built.

Michael earned a Bachelor of Science degree in Finance and Banking from the University of Missouri – Columbia. Additionally, he holds designations as a Chartered Financial Analyst (CFA) charterholder and Certified Financial Planner (CFP).

Beyond his professional achievements, Michael enjoys a fulfilling personal life in St. Louis. Living with his wife, Lindsey, and their beloved dog, Birk, he finds joy in activities such as golfing together and exploring local restaurants.