When Should You Start Collecting Your Social Security Benefits?

Getting Social Security benefits is pivotal for most retirement plans, but optimizing them requires careful consideration.

As a fee-only financial advisor, I typically advise my clients to delay claiming their Social Security for as long as possible, ensuring they secure the highest monthly payments throughout retirement. However, I acknowledge that this decision is deeply personalized and contingent on their unique circumstances and future aspirations.

In this guide, I’ll explain the three options for collecting Social Security, and outline the key factors to consider while deciding which strategy will best fulfill your long-term goals.

What is Social Security?

Social Security is a retirement benefit provided by the U.S. government. Funded through FICA (Federal Insurance Contributions Act) payroll deductions– around 15% of your income, half of which is covered by your employer– to provide financial support during your retirement years.

The contributions made during your working years directly correlate with the monthly income you’ll receive in retirement once you begin collecting benefits. They’re calculated based on the earnings from your highest 35-income years, with benefits, and contributions capped at an income level of $168,600. Reaching this income threshold is commonly known as ‘maxing out’ Social Security.

Why Does it Matter When I Start Taking Social Security Benefits?

The age at which you apply for Social Security significantly affects the amount of benefits you receive. Although the full retirement age is considered 67, retirees can opt-in to receive benefits anytime between 62 and 70. However, the government incentivizes retirees to delay benefits, up to age 70 by prorating the income amounts based on age.

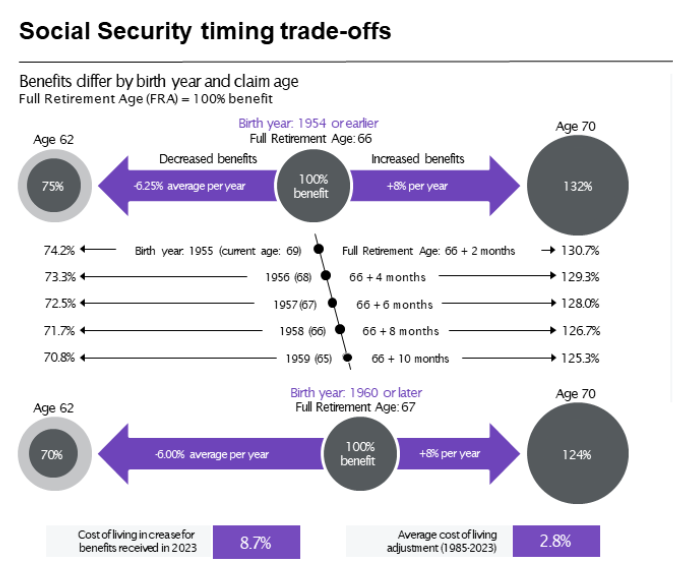

The timing of your Social Security benefits claim determines the amount you’ll receive.

Source: Guide to Retirement, J.P. Morgan

Here are the three options to consider:

1. Early Retirement Option | Age 62-66

Social Security eligibility begins at age 62. Starting benefits at the first opportunity is considered ‘early’ and results in a permanent benefit reduction. Retirees who start collecting Social Security at 62 can expect to receive only 70-75% of the full benefit.

A 30% reduced benefit amounts to a significant loss of money throughout your retirement. For instance, if the full monthly benefit would be $3,000 at age 67, starting early payments will lower your income by $900 a month. This leads to an overall loss of $194,400 across an average retirement of 18 years or $324,000 during a 30-year retirement.

Our takeaway:

Choosing the early option can be viable for individuals with limited options and a keen desire to retire sooner. In these circumstances, relying on Social Security to meet expenses becomes crucial, where receiving reduced benefits outweighs receiving no benefits. Ideally, it’s advantageous to tap into other resources to sustain your lifestyle until you reach the age of 67.

2. Full Retirement Age (FRA) Option | Age 66 or 67+

Retirees qualify for the full benefit starting at age 66 or 67, depending on birth year. Waiting until Full Retirement Age (FRA) safeguards a retiree’s ability to earn additional income without reducing their full benefit amount.

Our takeaway:

In most cases, FRA is the earliest option that we recommend. Many of our clients engage with this strategy because it eases the burden on other financial assets and allows them to comfortably manage their lifestyle without liquidating a high volume of investments.

3. Delayed Option | Age 68-70

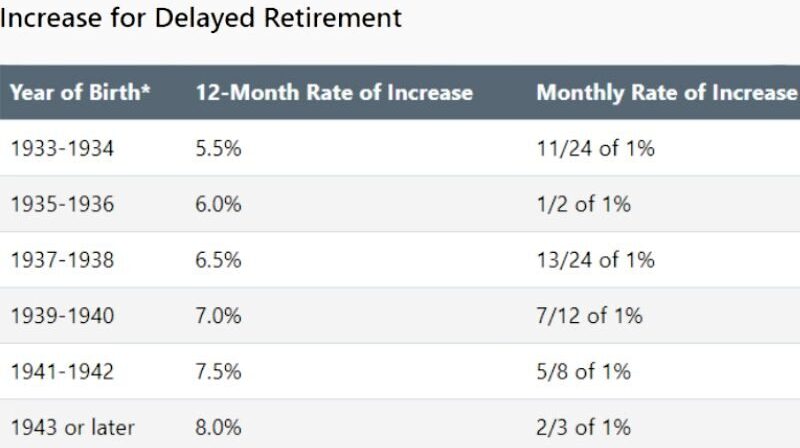

Delayed retirement credits reward individuals for every month they choose to delay benefits between the ages of 67 and 70.

This table shows what qualifies as full retirement age based on your birth year.

Source: Social Security Administration

Upon reaching 70 years old, retirees become eligible for approximately 130% of the full Social Security benefit, ensuring this enhanced payout for the rest of their lives. This additional benefit translates to a guaranteed 7 to 8% increment over several years, surpassing the growth rates of many other investment avenues.

Our takeaway:

Since there are no further incentives to hold out after 70, this is the latest you should wait before claiming these benefits.

Top 5 Questions to Consider Before Applying for Social Security Benefits

Above all else, the decisions around claiming your Social Security should align with your specific situation and expectations for retired life.

In my experience, there are five critical questions to consider when you start formulating a Social Security strategy:

1. Are you planning an early retirement?

As you examine the pros and cons of early retirement, the fixed income provided by Social Security deserves careful attention. When deciding to retire early, I often find that clients have overestimated how much Social Security they will receive each month.

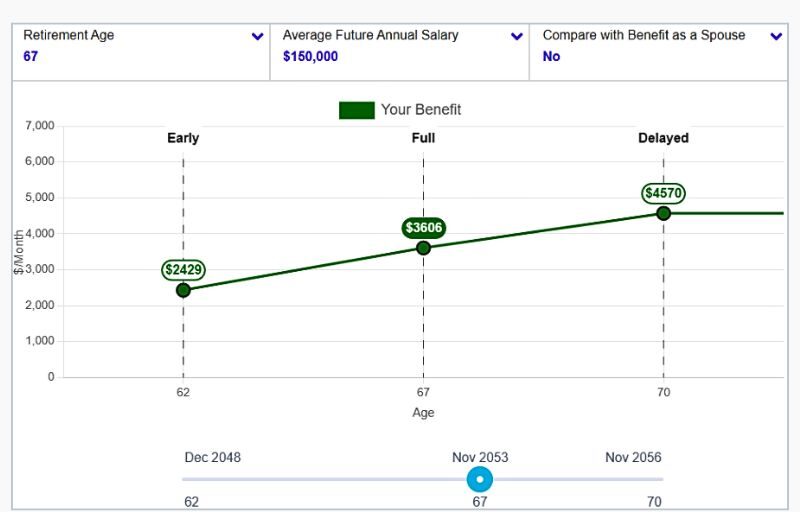

Benefit prediction tools like my Social Security (see sample below), operate on the assumption that you will maintain your current income level until age 67, or full retirement age. Choosing to retire before 67 refutes this assumption and the corresponding estimate.

Since benefit amounts are based on the 35 highest-income years of your career, early retirement disrupts this calculation and frequently reduces your full benefit amount. A financial advisor can provide a more precise benefit estimate to rely on while choosing when to leave the workforce.

A common pitfall of relying on these projections is misunderstanding how the projection is calculated. The Social Security Administration estimates your benefits based on the assumption that you’ll continue earning your current salary until you reach your full retirement age. If you intend to work fewer hours or retire before reaching FRA, your benefits will be less than the projected baseline. In this case, we recommend utilizing the Detailed Social Security Calculator for a more accurate estimation.

2. Will you have any additional income besides Social Security?

Additional sources of income can affect the taxability of Social Security. With zero additional income, Social Security is taxed at a very low rate, if at all. Whereas up to 85% of your Social Security income becomes subject to federal taxes if you generate considerable income from, for instance, investment properties or a pension.

This chart illustrates the ‘mySocialSecurity benefit prediction model’, assuming a retirement age of 67 and an annual income of $150,000.

Source: Social Security Administration

3. How does each option impact my spouse’s benefits?

If you are the higher-earning spouse, your husband or wife can choose between their full benefit or half of your benefit. The lower-earning spouse is entitled to whichever amount is greater, but they cannot combine the two.

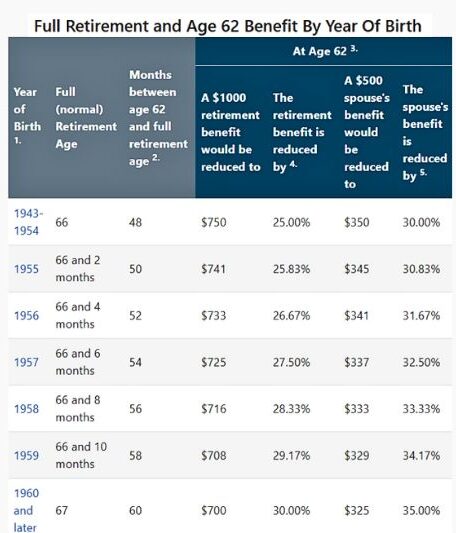

When the primary spouse claims Social Security benefits early, the spousal benefit is reduced 25/36 of 1% for each month before full retirement age. The table below demonstrates how electing for early benefits at age 62 impacts a retiree’s benefits as well as the spouse’s:

Opting for early Social Security reduces the benefit amount for retirees and spouses.

Source: Social Security Administration

4. What other resources can I pull from besides Social Security?

As a best practice, review and consider pulling from other assets in your portfolio before dipping into Social Security. The asset mix varies from client to client but often includes:

- 401Ks

- Individual Retirement Accounts (IRAs)

- Stocks or mutual funds

- Treasury investments (bonds)

- High-yield savings accounts

- Certificates of Deposit (CDs)

- Pensions

- Annuities

- Real estate investments

- Collectibles assets with resale value

At Toberman Becker Wealth, we work with clients to develop a withdrawal strategy that outlines precisely which accounts to pull from and when. Well-designed withdrawal plans balance current spending levels with projected investment returns while also considering the potential impacts of inflation.

5. Do you have any serious health concerns?

Consider your medical history and current state of health while establishing a retirement plan. Unfortunately, illness is a common, and often unexpected, detour for our clients. Collecting Social Security benefits earlier might be more sensible if you or your spouse have any preexisting medical issues or high-risk health concerns.

When is the best time to start pulling from Social Security?

Your current age and life expectancy are central data points to help inform decisions like when to claim Social Security. With an adequate financial portfolio, and a life expectancy in the mid-80s, the best option is to delay Social Security until age 70.

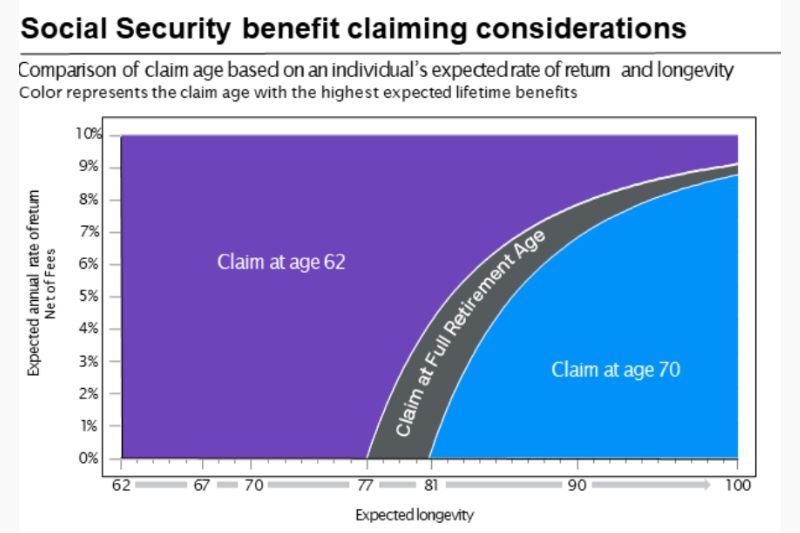

The financial benefits of delaying Social Security corresponded with your life expectancy.

Source: Guide to Retirement, J.P. Morgan

How can a financial advisor support your decision-making process?

Partnering with a financial expert ensures accuracy and fortifies your confidence to make the right choice for you and your family. The complexity and wide range of Social Security options can be overwhelming and hard to digest on your own. A trusted advisor simplifies the process and shoulders some of the stress while you decide which strategy to follow.

In conclusion

Deciding when to leave the workforce can change many facets of your life. The right Social Security strategy and financial plan will support you and your family as you settle into the changes.

Toberman Becker Wealth is a fee-only, independent fiduciary firm based out of St. Louis. Whether starting to dream about retirement in your 50s or actively planning for retirement in your 60s, we help people nearing a transition build a resilient retirement plan. We operate in the best interests of our clients, always, and our top priority is to help you live comfortably now, without sacrificing your financial future later.

If you’re looking for an investment advisor to help you build a diversified retirement plan that ensures comfort and peace of mind, feel free to book a meeting or give us a call.

Disclosure: Any mention of a particular security and related performance data is not a recommendation to buy or sell. The information provided on this website (including any information that may be accessed through this website) is not directed at any investor or category of investors and is provided solely as general information. Nothing on this website should be considered as personalized financial advice or a solicitation to buy or sell any securities.

Michael is a highly knowledgeable and experienced partner at Toberman Becker Wealth in St. Louis. With his expertise in investment management, behavioral finance, and retirement planning, Michael is dedicated to providing his clients with the best financial guidance possible.

Having worked with clients on complex estate planning and developing investment strategies for a team of advisors, Michael’s experience spans across various areas of financial planning. What truly sets him apart is his unyielding desire to acquire knowledge for the betterment of his clients. At Toberman Becker Wealth, this commitment to continuous learning is the foundation upon which exceptional client experiences are built.

Michael earned a Bachelor of Science degree in Finance and Banking from the University of Missouri – Columbia. Additionally, he holds designations as a Chartered Financial Analyst (CFA) charterholder and Certified Financial Planner (CFP).

Beyond his professional achievements, Michael enjoys a fulfilling personal life in St. Louis. Living with his wife, Lindsey, and their beloved dog, Birk, he finds joy in activities such as golfing together and exploring local restaurants.