A Happy New Year of Job Growth & Economic Prosperity in St. Louis

For the first time in over three decades, the St. Louis metro has claimed the third spot nationwide for job growth, according to the latest U.S. Bureau of Labor Statistics data. This achievement positions St. Louis as a rising star among major cities, a hub for career opportunities, and a beacon of promise for retirees seeking stability and growth. With a low cost of living and robust economic momentum, St. Louis is emerging as a prime destination to build a thriving career and secure retirement.

This article explores the key factors driving St. Louis’s economic resurgence and highlights how local trends can elevate your retirement planning strategy.

St. Louis Jobs Surge: Outpacing Chicago, Houston, and Austin in 2024

Between August 2023 and August 2024, St. Louis created 31,000 jobs, with Madison County seeing the most significant increase, adding nearly 4,000 workers. This brought total employment to nearly 1.5 million. The leisure and hospitality sectors led the way, contributing 12,000 new jobs, while the tech industry also saw notable growth.

St. Louis outpaced major cities like Chicago, Houston, and Austin, with only Las Vegas and Salt Lake City seeing higher growth rates:

- Las Vegas, Nevada | 3.7% increase

- Salt Lake City, Utah | 2.7% increase

- St. Louis, Missouri | 2.6% increase

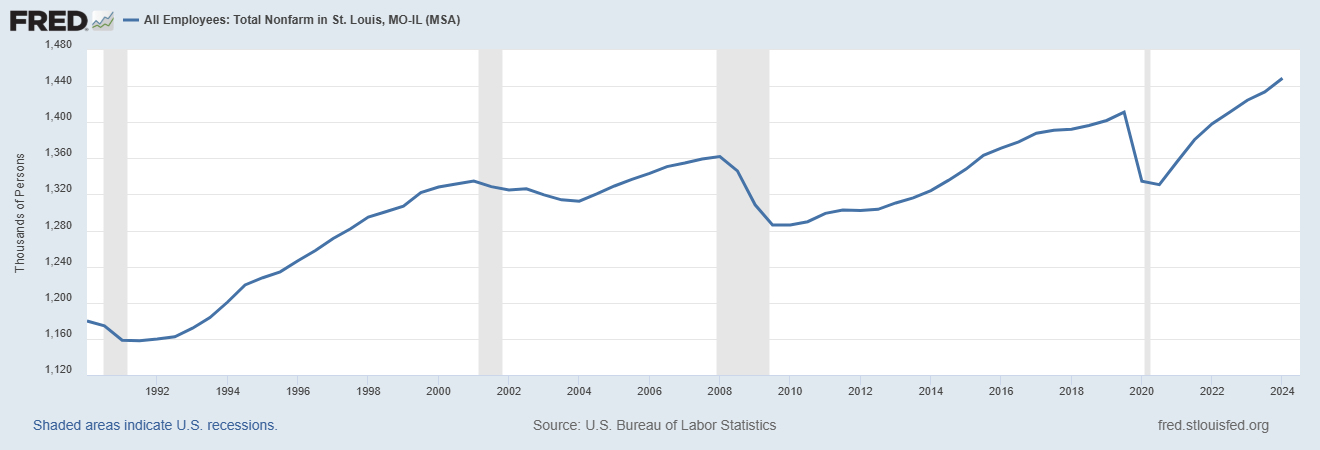

St. Louis employment rates have increased since a temporary dip in 2020, peaking in the first half of 2024 at 1,448,800 employees.

Source: Federal Reserve Bank of St. Louis

What’s Driving Recent Job Growth in St. Louis?

Local economic achievements, cultural investments, and long-term projects fuel St. Louis’s bright future. Key drivers include:

- Leisure & Hospitality Upgrades

The leisure and hospitality sectors have led the charge. Notable developments contributing to this growth include:- St. Louis Aquarium & Union Station

Historic renovations have significantly boosted local tourism, adding 500 jobs and attracting an estimated one million visitors annually. - CITYPARK Stadium

Major league soccer events at St. Louis CITY SC have increased downtown foot traffic, revitalizing businesses post-COVID. - City Foundry STL

This mixed-use development generates nearly $6 billion in revenue and offers locals and visitors year-round dining, retail, and entertainment.

- St. Louis Aquarium & Union Station

Leisure & Hospitality employment increased by 7.5% from June 2023 to June 2024, the most significant year-over-year increase by sector, surpassing Education & Health Services, which achieved 5.1% growth.

Source: St. Louis Public Radio

- Low Cost of Living

St. Louis boasts a cost of living 6% lower than the national average, making it an attractive destination for workers and retirees. Its affordable housing market and comprehensive amenities add to the city’s appeal. - Strong Municipal Finances

In July 2024, St. Louis received a bond rating upgrade from “A” to “AA,” showcasing financial stability and solid fiscal management. This draws investors toward low-risk municipal bonds, providing additional resources for the city. - Prominent Healthcare Sector

Healthcare, representing 14.8% of the St. Louis workforce, continues to expand, signaling long-term stability and growth in this critical industry. - Major Investments in Biotech

For the first time, Washington University surpassed$1.1 billion in research funding for AI and biotech for further economic growth. Every $1 million invested in research is expected to generate 11 local jobs.

How Does the Local Economy Impact Retirement Planning?

At Toberman Becker Wealth, we leverage local economic insights to project the cost of living in St. Louis, a critical factor in effective retirement planning. We utilize long-range scenario modeling with customized local data to create robust retirement strategies for our clients.

- Understand the Cost of Living & Spending Requirements

By analyzing job growth, income levels, and inflation specific to St. Louis, we offer more accurate retirement projections tailored to the local market. - Adapt Retirement Plan According to Local Economic Data

Our retirement models account for fluctuations in local economic factors, including inflation, healthcare costs, and changes in living expenses, ensuring your plan adapts as the local landscape evolves.

In Conclusion

We are grateful to call St. Louis home and honored to serve over 75 families in our community. The resilience and ingenuity of The Lou inspire us daily. Here’s to St. Louis’s continued prosperity and a prosperous 2025. We are proud to be #STLMade. Happy New Year!

Toberman Becker Wealth is a fee-only, independent fiduciary firm based in St. Louis. Whether you start dreaming about retirement in your 50s or actively plan for retirement in your 60s, we help people nearing a transition build a resilient retirement plan. We always operate in the best interests of our clients, and our top priority is helping you live comfortably now without sacrificing your financial future later.

If you’re looking for an investment advisor to help you build a diversified retirement plan that ensures comfort and peace of mind, feel free to book a meeting or give us a call.

Disclosure: Any mention of a particular security and related performance data is not a recommendation to buy or sell. The information provided on this website (including any information that may be accessed through this website) is not directed at any investor or category of investors and is provided solely as general information. Nothing on this website should be considered as personalized financial advice or a solicitation to buy or sell any securities.

Craig Toberman is a Partner at Toberman Becker Wealth – a fee-only, fiduciary financial advisor based in St. Louis. He assists families and businesses with strategic financial planning and long-term wealth management. He has over a decade of experience in financial services and has crafted custom financial plans for hundreds of families and businesses.